Tento som videl pred dvomi mesiacmi

a tento minulý rok

Koh-I-Noor a Cullinan mám tiež nakukaný, ale to bolo už dávnejšie... takže veľká štvorka je za mnou🙂

Processed coin catalogs 4.418 Auctions / 36.665 Lots

Všetko o bankovkách www.mojazbierka.sk :)

Sent from my ZX Spectrum

Rapaport Weekly Market Comment September 25, 2015

Hong Kong show OK but Chinese demand slow before Oct. 1 Golden Week. Polished buyers selective and making low offers. Certs slow with better demand for lower quality parcels. Polished production significantly reduced as cutters shrink existing inventory. De Beers says 2014 global production -3% to 142M ct., diamond jewelry demand +3% to $80B. Russia’s 1H rough exports -16% to $2.1B, production +8% to 18.5M cts. Petra Diamonds FY revenue -10% to $425M, profit -12% to $60M. Sotheby’s expects up to $4.6M/ct. for cushion-shape, 12.03 ct., fancy vivid blue, IF diamond. THE RAPAPORT PRICE LIST WILL NOT BE PUBLISHED ON OCT. 2 DUE TO JEWISH HOLIDAY OF SUCCOT.

RapNet Data: September 24

Diamonds 1,322,003

Value $8,624,848,174

Carats 1,397,556

Average Discount -27.80%

www.rapnet.com

The RapNet Diamond Index (RAPI) has been revised to reflect the average price of the 10 best priced diamonds in each category.

Get Current Price List | Subscribe to Rapaport | Join RapNet

RAPAPORT ANNOUNCEMENTS

October 12-13 Mon-Tue

IWJG Show

Brooklyn, NY

View Details

October 13-21 Tue-Wed

Rapaport Melee Auction

New York & Dubai

View Details

October 14-21 Wed-Wed

Rapaport Single Stone Auction

New York & Israel

View Details

RapNet is Fully Mobile

App now available on iOS and Android.

Download now.

QUOTE OF THE WEEK

There is reason to be optimistic, even though conditions do, of course, remain challenging overall.

Ernie Blom, president, World Federation of Diamond Bourses

MARKETS

United States: Diamond suppliers have not yet reported the usual rise in activity associated with the pre-Christmas holiday period. Still, demand is steady and there is some optimism that stronger orders will start to flow in the coming weeks...

Belgium: Activity in Antwerp was fairly subdued this week as the market focused on the Hong Kong Jewellery and Gem Fair. The mood has improved since the beginning of September when dealers returned from the summer break...

Hong Kong: The all-important September show met dealers’ low expectations with steady activity but lower visitor traffic and transactions than in previous years. The mood was relatively positive as dealers embraced the opportunity...

India: Sentiment remains weak in Mumbai as the Hong Kong show didn’t inspire renewed confidence among the local trade. There is business being conducted but transaction volumes...

Israel: The past week was a fairly rushed one for many Israeli diamantaires who traveled to the Hong Kong show between the Jewish holidays of Rosh Hashanah and Yom Kippur. Consequently, activity in the Israel Diamond Exchange was light...

INDUSTRY

De Beers Highlights India’s Role in Countering Flat Growth

The world’s largest diamond miner sees the industry’s biggest opportunity in India, given its burgeoning economy and emerging middle class, based on The De Beers Group of Companies’ Diamond Insight Report 2015.

The company reported that world demand for diamond jewelry in 2014 rose 3% to more than $80 billion for the first time, as global rough diamond production rose 6% to $19 billion.

Meanwhile, India’s consumer diamond market has achieved almost uninterrupted growth over the last 20 years and is now one of the world’s largest consumer markets. At the same time, retail behavior is changing as chains are set to grow in significance and lead the way in online development, both as sales channels and as a means of researching future purchases, De Beers concluded.

Diamond demand grew in all five of the top-consuming markets – the U.S., China, Japan, India and the Gulf Cooperation Council nations, which account for 75% of global purchases, according to the report. Elsewhere, growth was stymied by a strong dollar.

Russia’s Rough Diamond Exports Slide

Russias rough diamond exports fell 16% year on year to $2.13 billion in the first half of 2015, Itar-Tass reported, citing the country’s Ministry of Finance. By volume, exports declined 10% to 17.83 million carats. Rough imports rose 70% to $46.5 million as volume more than tripled to 28,000 carats.

The country’s diamond production rose 8.3% to 18.5 million carats in the first half, with the value of production up 22% to $2 billion. The ministry also reported that the average price of production increased by 13% to $109.13 per carat, an estimate based on Finance Ministry pricing, which does not correspond with market prices but rather follows the insurance value of the diamonds, per Interfax.

ALROSA, which accounts for the bulk of Russia’s diamond production, reported that its production grew 13% to 18 million carats in the first half, while the average price of its sales have fallen 6% since the beginning of the year. The company has since reduced prices by 8% to 10% and allowed its clients to defer 50% of their allocated supply at the September sale, sources confirmed with Rapaport News.

Diamond Industry’s Outlook Heading into Holiday Season Seen Positive

The outlook for the global diamond trade could be positive in the upcoming holiday season given the early indications that the Hong Kong Jewellery and Gem Fair has been solid and as the world’s two main producers cut prices.

Last week, ALROSA said it would reduce prices by up to 10 percent at its September sale, according to a press statement issued by the World Federation of Diamond Bourses (WFDB). That followed De Beers decision to slash prices by similar levels at its August sight.

Such steps are bringing down prices to more realistic levels, the statement released from Antwerp said on September 22. In addition, the much-needed cuts in polished production have been carried out, particularly by the Indian manufacturing sector.

“I feel there is reason to be optimistic, even though conditions do, of course, remain challenging overall,” Ernie Blom, president of the WFDB, which has 30 affiliated bourse members, said. “The Hong Kong show, due to the global nature of its exhibitors, buyers and visitors, serves as a useful barometer of industry sentiment, so it is very promising that demand at the fair was stable.”

RETAIL & WHOLESALE

U.S. Jewelry Demand Shows Improvement in July

U.S. sales of fine jewelry and fine watches increased by 3.5 percent in July, according to the latest data from the U.S. Department of Commerce.

Specialty jewelers, stores with a majority of their revenue from jewelry and watch sales, showed a 2.9 percent sales increase in the month. Jewelry sales through larger, big-box merchants such as Wal-Mart and Costco rose an estimated 3.9 percent in July. Historically, July sales are less than 8 percent of the industry’s annual sales, with few promotional and sales events.

The Commerce department revised monthly sales data for May and June, which had shown either sales declines or very small gains for the total industry. Data for both specialty jewelers and the total U.S. jewelry industry were revised and while specialty jewelers’ June sales gains now reflect a more modest increase.

Independents’ Share of Diamond Jewelry Market Slips

Independent jewelers’ share of the U.S. diamond jewelry market has fallen, with chains and online grabbing a larger piece of the pie, according to the recently released De Beers’ Market Insight Report.

Single-store independents remain the biggest sales channel in the diamond jewelry market, but not by much, according to De Beers, which found that those independents accounted for 35% of diamond jewelry sales in 2014 and national chains ranked close behind with 31%. Before the recession of 2007, however, the industry saw a far greater spread, with independent jewelers claiming 56% of the market and national chains just 25%.

Meanwhile, small and medium-size chains — defined as chains with between two and 10 stores — saw their market share expand from 2% in 2007 to 11% last year.

Tara Jewels Enters Exclusive Agreement with Sterling

India’s Tara Jewels signed an exclusive manufacturing and supply deal with Sterling Jewelers Inc., a part of Signet Group, for the designer brand Angel Sanchez. The brand’s offerings have been assigned an initial value of more than $4.4 million, including designs that are being preliminarily tested in about 60 stores.

Sterling Jewelers Inc. has approximately 1,400 stores in the U.S. Tara Jewels designs and manufactures jewelry and has retail operations in India.

Tiffany & Co.’s Grows Global Footage

Tiffany & Co. is seeking to enhance its customers’ in-store experience by increasing its store space at the rate of 2% to 3% a year and improving client service, Ralph Nicoletti, the company’s CFO and executive vice president, told investors at the Stifel 2015 Consumer Conference in New York.

Nicoletti said that Tiffany & Co. had targeted mid- to high-single-digit sales growth, improved operating margins and doubled-earnings growth “over the long term.”

Tiffany opened new stores in 2014 in Moscow and on the Champs-Élysées in Paris, and this year opened locations in the Miami Design District and Shanghai. The planned annual increase in global footage is to be enacted “for the foreseeable future,” according to Nicoletti. The retailer opened 11 new stores during the fiscal year that ended on July 31, 2015.

Nicoletti also stressed the importance of “vertical integration” within the company’s supply chain and said it now internally manufactures more than half of the products it sells and sources a “high percentage” of its diamond requirements in a rough form from producers.

Ivanka Trump Jewelry Seller Ordered to Pay $2.4M

Madison Avenue Diamonds, the company behind the Ivanka Trump Fine Jewelry brand, has been ordered by the New York State Supreme Court to pay $2.375 million plus interest to De Beers sightholder KGK Jewelry following a long-running dispute.

Madison Avenue Diamonds had claimed that it was not obliged to complete the payment of $3 million in a series of installments to KGK that had been agreed upon by the two parties when they terminated a supply arrangement in 2012.

Madison Avenue Diamonds argued that KGK’s failure to return certain computer design files before the agreed-upon 45-day deadline, following the closure of their contract, had constituted a “material breach” and that Madison Avenue Diamonds was therefore relieved of its financial obligations.

It took KGK 46 days to send the files back. Judge Charles E. Ramos ruled that Madison Avenue Diamonds had not been released from its obligation to pay because the agreement did not indicate that “time was of the essence” and there was no sign that Madison had been damaged by the one-day delay.

The court rejected Madison Avenue Diamondss arguments that the jewelry KGK provided was “of substandard quality,” which KGK described as a “belated attempt to amend its claims and defenses.”

MINING

Botswana Diamonds, ALROSA Start Orapa License Work

Botswana Diamonds reported that work is underway on three prospecting licenses in the Orapa region of Botswana that are part of a joint venture between the African exploration group and ALROSA.

Heavy concentrate sampling and reconnaissance work have begun, to be followed by heavy concentrate sampling to evaluate kimberlite indicator minerals and how close they are to potential primary sources.

Following this venture, the team will carry out verification sampling on smaller licensing areas in the Gope region of Botswana, with the aim of defining potential new drill targets.

Petra Diamonds’ Profit Drop

Petra Diamonds reported double-digit percentage drops in both profit and revenue for its fiscal year that ended on June 30, on the back of a weakened market and low prices. The company’s revenue fell 10% to $425 million, while its adjusted net profit after tax was down 33% to $62.8 million.

CEO Johan Dippenaar also attributed the decrease to the reliance of Petra’s underground mines on “mature, diluted mining areas,” but said this drop and current negative market conditions were partly offset by currency weakness. In a later conference call with investors, Dippenaar said the impact of lower rough diamond pricing was partially hedged by the positive impact of the weaker rand – down 10% against the dollar – on the company’s cost base.

GENERAL

AGTA Elects New Officers

The American Gem Trade Association (AGTA) announced its newly elected board of directors, who will take office in February 2016 for three-year terms. Jeffrey Bilgore of Jeffrey Bilgore LLC was elected president. Cynthia Renée (Marcusson) of Cynthia Renee Inc. and Avi Raz of A & Z Pearls Inc. were re-elected to the board. Kusam Malhotra of K & K International and Jeff Mason of Mason-Kay Inc. were newly elected members.

Continuing board members include: Gerry Manning, vice president; Pramod Agrawal, treasurer; Bruce Bridges; Charles Carmona; William Heher; Gina Latendresse; Niveet Nagpal; Robert Van Wagoner; Simon Watt and Larry Woods.

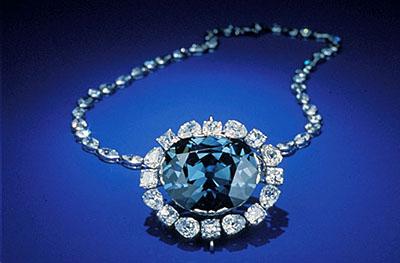

Sothebys May Fetch Record $55M for Blue Moon Diamond

The Blue Moon, a fancy vivid blue diamond weighing 12.03 carats and described by the Gemological Institute of America (GIA) as “internally flawless,” could sell for a record $55 million (EUR 47 million) when it goes up for auction on November 11 in Geneva, Sothebys announced.

The auction house estimates that its sale price will range between $35 million and $55 million, which, at the higher end, would set a record for any diamond sale.

The diamond will be exhibited in Hong Kong, London and New York ahead of the sale. The Blue Moon, discovered in South Africa, will be the largest cushion-shaped stone in that category to ever appear at auction.

Amnesty Reports on CAR Blood Diamonds

Amnesty International announced that it will publish a new report on the diamond industry that focuses on the Central African Republic (CAR), where illicit trade continues unabated amid sweeping conflict. Research for the report was conducted in the CAR, neighboring countries and the diamond-trading centers, Antwerp and Dubai, according to an Amnesty announcement.

The findings revealed systematic failures in preventing the trade of “blood diamonds,” according to Amnesty International. Due out September 30, the report will address illegal and unethical practices across the sector, including how armed groups in the CAR, as well as diamond traders in both the CAR and global trading centers, profit from illegal and unethical activity.

Edinburgh Assay Brings Diamond Certification to Heathrow

The Edinburgh Assay Office introduced a new diamond certification option for its Hallmarking in Transit service at London’s Heathrow Airport. The service, to be provided by Solitaire Gem Labs (SGL), will enable precious metal jewelry importers from outside the U.K. to have their goods hallmarked and certified at one secure location as part of the import process.

Scott Walter, the CEO and assay master of the Edinburgh Assay Office, explained, “This further simplifies the logistics process for importers and provides the flexibility to source product from multiple locations whilst retaining a single, logistically efficient route to market.”

Five Firms Awarded RJC Certification

The Responsible Jewellery Council (RJC) awarded five companies the Christian Dior certification for meeting the organization’s “highest ethical, human rights, social and environmental standards.”

The firms include the Gem Certification & Assurance Lab, a diamond, gemstone and jewelry certification laboratory headquartered in New York; French polished diamond distributor Messika Diamonds; Paris-based retailer Christian Dior Couture; precious metals provider Cookson Métaux Precieux – CooksonCLAL and Indian fancies manufacturer Ashwin Diamonds.

German Designer Wins Gem Empathy Award at IJL

The Gemmological Association of Great Britain (Gem-A) named Frankfurt-based Marina Jacob’s ‘Crushed Ice’ ring as the winner of this year’s Gem Empathy Award. Jacob, a designer and manufacturer of fine diamond and gem set jewelry, designed the stunning ring with a 13.83 ct. green beryl and 30 baguette diamonds.

Gem-A’s Gem Empathy award is presented annually on the last day of International Jewellery London to the exhibitor displaying, in the opinion of the judges, a single piece or collection of jewelry that makes captivating use of one or more gemstones and provides accurate ethical descriptions as well as displaying creativity and imagination.

ECONWATCH

Diamond Industry Stock Report

Industry retailer stocks broadly declined this past week with the exception of Birks Group (+12.7%), which bounced back last weeks 18-month low. Mining shares also declined, led by Petra Diamonds (-16.8%) and De Beers parent Anglo American (-16.2%). Platinum (-7.4%) fell to a five-year low.

View the detailed industry stock report.

(12:00 GMT) Sept. 24 Sept. 17 Chng.

$1 = Euro 0.8886 0.8829 0.006

$1 = Rupee 66.22 66.171 0.0

$1 = Israel Shekel 3.9508 3.8707 0.08

$1 = Rand 13.9899 13.3706 0.62

$1 = Canadian Dollar 1.338 1.3199 0.02

Precious Metals

Gold $1,136.07 $1,117.71 $18.36

Platinum $934.31 $964.40 -$30.09

Silver $14.79 $14.86 -$0.07

Stock Indexes Chng.

BSE 25,863.50 25,963.97 -100.47 -0.4%

Dow Jones 16,279.89 16,739.95 -460.06 -2.7%

FTSE 5,989.42 6,216.86 -227.44 -3.7%

Hang Seng 21,095.98 21,854.63 -758.65 -3.5%

S&P 500 1,938.76 1,995.31 -56.55 -2.8%

Yahoo! Jewelry 1,001.53 1,009.66 -8.13 -0.8%

Múdry sa teší objaveniu pravdy, hlupák falošnosti.

Rapaport Weekly Market Comment October 9, 2015

HK’s Golden Week weak as mainland Chinese tourists stay home. Buyers waiting for price cuts from sellers who need cash. Israel and New York slow as dealers return from holidays. India remains slow, particularly 1.5 ct.+ goods. Commercial goods better than high end with 0.50-0.75-ct., H-I moving better than 1 ct., D-F, VVS goods. Slight price reductions at De Beers sight offset by changes in size assortments. Buyers not confident with manufacturing down about 50% in lead-up to November’s Diwali festival. Belgium trade showing some signs of life after sluggish September, with increased U.S., European demand. Bharat Bourse bans synthetics. U.S. polished diamond imports +4% in August.

RapNet Data: October 8

Diamonds 1,299,251

Value $8,552,402,454

Carats 1,397,886

Average Discount -28.46%

www.rapnet.com

The RapNet Diamond Index (RAPI) is the average price for the top 25 diamond qualities (D-H, IF-VS2). It is based on the 10 best priced diamonds for each quality.

Get Current Price List | Subscribe to Rapaport | Join RapNet

RAPAPORT ANNOUNCEMENTS

October 12-13 Mon-Tue

IWJG Show

Brooklyn, NY

View Details

October 13-21 Tue-Wed

Rapaport Melee Auction

New York & Dubai

View Details

October 14-21 Wed-Wed

Rapaport Single Stone Auction

New York & Israel

View Details

RapNet is Fully Mobile

App now available on iOS and Android.

Download now.

QUOTE OF THE WEEK

We are not opposed to trading in synthetic/laboratory-created diamonds and accept that there could be a market for them.

Ernie Blom, president, World Federation of Diamond Bourses

MARKETS

United States: New York diamantaires waiting for signs of price stability before stocking up for holiday season. Retail sales of round diamonds under 1 ct. remain strong with continuing demand for ovals and cushions...

Belgium: Antwerp showing some signs of improvement from September, with European and U.S. buyers filling anticipated holiday needs...

Hong Kong: Golden Week weak as strong foot traffic didn’t turn into sales as Mainland tourists stayed home...

India: Market slow and uncertain as international buyers wait for price stability. Manufacturers’ profit under continuous pressure as De Beers fails to significantly reduce rough prices...

Israel: Market waking up as diamantaires return from several weeks of Jewish holidays. Better demand for commercial goods than high quality certs...

Click here to continue reading

INSIGHTS

Look to the Holidays to Gauge the Trade’s Foreseeable Future

If things in the diamond trade were business as usual, strong sales during Christmas and the Chinese New Year in early February would reduce retail inventory and by March bring fresh orders for goods throughout the distribution chain...

Click here to continue readin

INDUSTRY

U.S. Polished Diamond Imports +4% in August

U.S. polished diamond imports increased 3.9% year on year to $1.62 billion in August. The average price for polished goods rose 5.3% to $1,861 per carat, according to Commerce Departmentdata releasedon October 6.

Polished exports fell 16% to $1.34 billion, resulting in a surplus of $281.6 million compared with a deficit of $33 million in August 2014.

Rough diamond imports more than doubled in August to $43 million, while rough exports rose 16% to $31.7 million, leaving net rough imports at $11.3 million compared with $7.8 million last year. The net diamond account shows imports exceeded exports by $292 million compared with last year’s $41.7 million deficit.

During the first eight months of the year, polished diamond imports rose 1% compared to the same period in 2014 to $16 billion and polished exports fell 12% to $12.9 billion.

Bharat Bourse Bans Synthetic Diamond Dealing

The Bharat Diamond Bourse (BDB) approved measures to stem the sale of synthetic diamonds on its premises going forward, requiring that only "natural diamonds" be sold at the Mumbai facilities, Rapaport News learned.

The action was approved by "an overwhelming majority" of the bourse’s members at its annual general meeting, market representative Shaji Narayanan confirmed in an email on October 1, noting that BDB is the “first and only diamond bourse to declare its entire premises as a natural diamond zone.”

The new rule applies to all synthetics, including chemical vapor deposition (CVD) stones. The disciplinary actions that would be taken against dealers who violate the new measures were not specified.

WFDB Supports Bharat Ban, Ethical Synthetics Trade

The leadership of the World Federation of Diamond Bourses (WFDB) isnt opposed to the synthetic diamond trade, but also takes no issue with Bharat Diamond Bourse’s decision late last week to ban laboratory-made stones, including chemical vapor deposition (CVD) stones.

WFDB president Ernie Blom commented in a statement that “each WFDB-affiliated exchange is within its rights to decide on its policy on the issue,” clarifying that “the WFDB is not opposed to the trade in such stones as long as they are fully disclosed.”

“Each of our member bourses, of course, has full decision-making power regarding which types of diamonds can be bought and sold within their premises as long as the decisions are made in line with the WFDBs regulations,” Blom explained.

“We are not opposed to trading in synthetic laboratory-created diamonds and accept that there could be a market for them. We only insist that such stones are fully disclosed so that the trade and consumers know exactly what they are being offered. This is critical in ensuring consumer confidence.”

De Beers: China’s Polished Diamond Sales to Jump 3% to 5%

China’s polished diamond sales will grow by 3% to 5% this year to about $290 million, De Beers Stephen Lussier, head of the Forevermark brand, said in a Reuters report, reversing an earlier company prediction of flat revenue for 2015.

Lussier explained that “the bridal business and the gifting business, particularly amongst younger consumers in China, is really today the main growth area.”

Forevermark’s like-for-like sales hit a record high in August 2015, after Chinese Valentine’s Day.

Sarine Launches Super-Fast Mapping Technology

Sarine Technologies released a system for inclusion mapping small diamonds called Meteor that could increase the speed of scanning to 220 stones per day.

The Israeli equipment maker, which focuses on technology for the evaluation, planning, processing, finishing, grading and trade of diamonds and gemstones, said that the new system was designed to provide “faster, cost-effective” inclusion mapping for the 0.25- to 0.85-carat segment of rough diamonds.

Israel Bourse Gears Up for ‘Rough October Fest

The Israel Diamond Exchange (IDE) will host a “Rough October Fest” featuring numerous rough diamond tenders and sales in the Ramat Gan diamond trading complex.

Rio Tinto will open the proceedings with its tender, to be held in the trading hall from October 11 to 15. The tender will offer 10.8-plus-carat and fancy colored rough diamonds through a sealed-bid auction system.

Tzoffey’s tender will run from October 18 to 26, with an all-African sale of 5- to 10-carat goods, along with special 10.5-plus-carat stones. De Beers will hold a sale of 5-plus-carat and 10-plus-carat goods from October 25 to 27.

A “Blue-White Diamond Dealing Day” will also take place in the IDE trading hall, with traders offering rough diamonds for inspection and immediate sale, as well as polished goods.

Dubai Diamond Exchange Sets Financing Seminars

The Dubai Diamond Exchange (DDE) will hold an inaugural series of seminars to raise awareness of diamond-financing options and explore ways in which the emirate’s trade infrastructure and financial institutions can support the industry.

The first of three Dubai Diamond Finance seminars will be organized at the Almas Tower in Jumeirah Lakes Towers on October 25. The event will host representatives from diamond manufacturers, including Dilip Mehta, chief executive officer of Rosy Blue, and Aditya Gandhi, director of Azure Diamonds.

While “there is a drought when it comes to finance options available to diamond buyers on a global scale," local lenders in Dubai are making finance options available, Mehta said.

Davy Blommaert, unit head for precious metals and diamonds at the National Bank of Fujairah, and Peter Meeus, executive chairman of the Dubai Diamond Exchange, will chair the discussions.

RETAIL & WHOLESALE

Sotheby’s Sells $18.4 Million of Diamonds

Sotheby’s sold $18.4 million worth of diamonds at its recent two-day Important Jewels sale on September 23 and 24 in New York, including an emerald-cut, 30.15-carat, F-color diamond ring purchased for $2.6 million, Blouin Artinfo reported.

A number of lots from the estate of Dolores Sherwood Bosshard fetched a total of $2.3 million, or nearly double the pre-sale estimate, including a sapphire and diamond stylized bow brooch by Van Cleef & Arpels dating back to 1937, which sold for $162,500.

A platinum bracelet by Harry Winston, circa 1960, with diamonds weighing a total of 101 carats and engraved on the bracelet cluster-style, was auctioned for $424,000. A cushion-cut, 43.25-carat sapphire framed by round and marquise-shaped diamonds weighing 2.90 carats sold for $802,00.

Luk Fook CFO Not ‘Optimistic’ About Golden Week Sales

While Luk Fook stores have seen an increase in store traffic in the initial days of China’s Golden Week festival, Kathy Chan, the retailer’s executive director and CFO, cautioned that “I don’t feel we should be optimistic about the figures” in an interview with Bloomberg Television.

Chan added that gem and jewelry sales in Mainland China are offsetting a current downturn in Hong Kong and Macau. The majority of Luk Fook’s more than 1,383 stores are located on the mainland.

Michael Hill Sales +9.9%, Same-Store Sales +6%

Michael Hill reported a 9.9% increase in sales to $80.8 million (AUD 112.5 million) for the three months through September, while same-store sales rose 6% to $76.8 million.

The New Zealand-based retailer has also released results for the Emma & Roe brand for the first time, with same-store sales rising 44.6% to $813,964. It said the directors were pleased with sales of the brand, which is still in the second year of a trial phase, and added that it plans to open an two new stores in the coming months, bringing the total to 11.

This would take the brand to a critical mass in the South East Queensland market and give the company the best indication of its commercial viability, it commented.

Meanwhile, the group said in a statement that Michael Hill New Zealand same-store sales grew 8.6 per cent in local currency to $15.6 million (NZD 23.6 million), while same-store sales for the main brand in Canada nudged up 2.9% to $12 million (CAD 23.6 million). The group opened three new Michael Hill stores, giving a total of 291 stores trading at the end of the quarter.

U.S. same-store sales for the brand were up by just 1.2% to $2.1 million.

MINING

Firestone’s Sale of Botswana Assets Hits a Snag

Firestone Diamonds stated that the sale of its Botswana operations to Tango Mining Ltd. met with an obstacle after Tango said it was unable to pay the deposit required by the sale agreement.

Tango had been required to pay $300,000 into an escrow account as a deposit for the $7.7 million acquisition of Firestone’s Botswana assets and, after failing to do so, requested an extension of the deal’s timetable to complete its fundraising.

Firestone said it is holding talks with Tango to consider the request and that it will provide an update once the talks are completed or terminated.

Botswana’s Rough Exports -15%

Exports of rough diamonds from mines in Botswana fell 15% to $1.7 billion (Pula 18 billion) in the first half, while the country’s August exports totaled $358.5 million, according to the Bank of Botswana.

Most of the exports came from Debswana, a joint venture between the Botswana government and De Beers. Debswana produced 4% less year on year in the first half, according to Reuters. The company had previously cut its full-year production target to 20 million carats from 23 million carats.

Diamond exports contribute 30% to the country’s gross domestic product, but diamond demand has slowed since late 2014 due to the dollar strengthening against the Pula and liquidity problems.

Lucapa Confirms Kimberlite at Angola Project

Lucapa Diamond Company identified the presence of confirmed kimberlite material at its Lulo project in Angola. The miner called the identification a “significant outcome” of its pitting and grade control programs around the Mining Block 8 alluvial diamond field.

Lucapa also announced that pitting has successfully expanded the mining block, which has been the source of rare, D-color, Type II gems and fancy color diamonds weighing more than 10.8 carats.

Diamcor’s Revenue +49%

Diamcor Mining reported a 70% increase in rough diamond carat sales for its fiscal second quarter compared with the previous fiscal quarter, alongside a 49% hike in revenue to $676,835.

The Canadian group, which operates a strategic alliance with Tiffany & Co. Canada, reported that it participated in one rough diamond tender during the period, where it sold 4,845.93 carats.

The company also reported a large increase in the volume of rough diamonds recovered but not tendered. It now holds around 4,030.83 carats of rough in inventory, compared to roughly 2,050 carats at the close of the previous fiscal quarter, a 96% increase.

Diamcor attributed this rise in rough inventory to initial increases in processing levels and subsequent recoveries, as well as its decision to leave certain higher-value rough diamonds out of its second-quarter sale due to recent low prices. The company said these diamonds would be offered again through tenders it expects to hold in the coming quarter.

GENERAL

3D Jewelry Printing Could Be $11B Industry

Three-dimensional jewelry printing could become an $11 billion market by 2020, according to “Opportunities for 3D Printing in Precious Metals,” a report published by SmarTech Markets that claims this technology could have a disruptive impact on the industry, based on the predicted value of rings, necklaces, watches and other common consumer fashion items produced through 3D printing.

The idea is close to entering “new territory” through timepiece components, directly fabricated jewelry and accessories made from precious metal powder, according to the report, which cited 3D printer manufacturers that are already involved in the industry, including 3D Systems, Solidscape (wax models), Concept Laser, EnvisionTEC, EOS and Realizer, as well as service bureaus Shapeways and Sculpteo, 3D software manufacturer Autodesk and Progold, which makes gold and other alloy powders.

DEF Awards Higher-Education Grants

The Diamond Empowerment Fund (DEF), co-founded by De Beers, donated $122,500 to the African Leadership Academy (ALA) to help “outstanding” young students gain access to higher education.

ALA co-founders Fred Swaniker, a former consultant at McKinsey & Company, and Chris Bradford, who previously worked for Procter & Gamble and Boston Consulting Group, received the DEF grant at a ceremony in New York.

The Johannesburg-based academy offers a two-year program to prepare pupils for college, focusing on leadership, entrepreneurship and African studies. Graça Machel Mandela, the widow of former South African President Nelson Mandela, was also present at the award event and participated in a discussion on preserving African identity, handling urgent social issues and motivating the next generation of Africans to effect change on the continent.

Berkshire’s Richline Joins Anti-Wildlife Trafficking Effort

Richline Group, a wholly owned subsidiary of Berkshire Hathaway, joined forces with other jewelers to campaign against the illegal acquisition of wildlife products by the precious stones industry.

Richline, a Tamarac, Florida-based jewelry maker and marketer, teamed up with firms such as Ethical Metalsmiths, Wildlife Friendly Enterprise Networks and Jewelers of America to cut the demand for and supply of such products.

The campaign also aims to raise awareness of the wildlife trafficking crisis and support President Obama’s U.S. Wildlife Trafficking Alliance, which was launched in 2013.

WDC Criticizes Amnesty CAR Report

The World Diamond Council (WDC) has become the latest body to come out against a recent Amnesty International report that claimed diamond trafficking was being used to fund violence in the Central African Republic (CAR).

In an interview with Bloomberg, WDC president Edward Asscher that the Kimberley Process (KP) had taken “more than 99%” of conflict diamonds off the market.

"The diamond council gladly re-invites Amnesty to participate and join us and the [KP’ civil society coalition looking into aspects of CAR and the whole Kimberley Process," he added.

The KP has banned diamonds exports from the CAR since May 2013, two months after the overthrow of President Francois Bozize, a Christian, by mostly Muslim militias.

Amnesty legal adviser Lucy Graham told Bloomberg the organization’s report was “a damning indictment of the Kimberley Process and its failure over a number of years to address human rights abuses and other illegal and unethical practices" and demanded stricter laws to require companies to investigate their supply chains and disclose what preventative measures they have take

PDE Picks Khemlani as New President

The Panama Diamond Exchange (PDE) elected Mahesh Khemlani as its next president, replacing longstanding CEO Erez Akerman.

Khemlani, Panama’s former vice minister of finance, will join the bourse from Panamanian private investment firm Grupo VerdeAzul.

The bourse also announced that Ali Pastorini, director of marketing for the World Jewelry Hub, the trading center that opened in Panama earlier this year, would become the PDE’s senior vice president.

Akerman, who is stepping down at the end of October, is set to become managing director of the World Jewelry Hub. He has been president of PDE since the bourse’s founding in 2008.

Etsy to Offer Networking Service for Designers, Manufacturers

Etsy, a peer-to-peer e-commerce site focused on handcrafted or vintage items, including jewelry, is set to launch Etsy Manufacturing, a marketplace for designers and manufacturers.

The venture, which will go live this year, will enable designers to search for and contact manufacturing partners. Etsy is already accepting applications from manufacturers at its website. The venture is the result of a pilot program launched by the company earlier this year that found that in normal circumstances “finding a good partner is really, really hard.”

While it will not conduct direct audits or site visits, Etsy said it will review and approve manufacturers’ applications on an individual basis, based on criteria that includes a commitment to transparency, the degree to which a company allows subcontracting and the participant’s business size.

AWDC to Send Local Text Alerts in Emergencies

The Antwerp World Diamond Centre (AWDC) is introducing a notification system that will inform users by text message of any security incident that arises in the city’s diamond hub.

AWDC said the SMS alert mechanism was designed to update the Antwerp diamond community quickly in the event of a “serious and ongoing emergency” within the Antwerp Diamond Area and, if necessary, to provide evacuation guidance.

The service is free of charge, though registration is subject to review.

ECONWATCH

Diamond Industry Stock Report

View the detailed industry stock report.

(13:30 GMT) Oct. 8 Oct. 1 Chng.

$1 = Euro 0.89 0.90 -0.007

$1 = Rupee 65.04 65.52 -0.5

$1 = Israel Shekel 3.85 3.93 -0.08

$1 = Rand 13.42 13.85 -0.43

$1 = Canadian Dollar 1.31 1.33 -0.02

Precious Metals

Gold $1,144.83 $1,115.41 $29.42

Platinum $948.05 $903.75 $44.30

Silver $15.69 $14.57 $1.12

Stock Indexes Chng.

BSE 26,845.81 26,220.95 624.86 2.4%

Dow Jones 16,902.93 16,284.70 618.23 3.8%

FTSE 6,355.94 6,105.07 250.87 4.1%

Hang Seng 22,354.91 20,846.30 1,508.61 7.2%

S&P 500 1,995.83 1,920.03 75.80 3.9%

Yahoo! Jewelry 1,043.36 1,004.14 39.22 3.9%

Múdry sa teší objaveniu pravdy, hlupák falošnosti.

Rapaport Weekly Market Comment October 16, 2015

Current rough prices unsustainable and unacceptable. Cutters reject about 50% of De Beers sight. ALROSA prices -15% so far this year. We believe rough prices need to fall at least another 20% to ensure profitability. 1ct. RAPI -3% in Sept., -6.3% in 3Q. U.S. good before Christmas, Far East slow after weak Golden Week. U.S. and Israeli dealers “cherry-picking” Indian goods before Mumbai shuts for Diwali (Nov. 7-13). Chow Tai Fook 2Q gem jewelry same-store sales -13%, Luk Fook -26%. LVMH Jan.-Sept. jewelry, watch sales +22% to $2.7B. Belgium Sept. polished exports -12% to $1.4B, rough imports -35% to $870M. India Sept. polished exports -28% to $1.9B, rough imports -29% to $1.1B.

RapNet Data: October 15

Diamonds 1,264,656

Value $8,442,621,802

Carats 1,373,164

Average Discount -28.86%

www.rapnet.com

The RapNet Diamond Index (RAPI) is the average price for the top 25 diamond qualities (D-H, IF-VS2). It is based on the 10 best priced diamonds for each quality.

Get Current Price List | Subscribe to Rapaport | Join RapNet

RAPAPORT ANNOUNCEMENTS

October

13-21

Tue-Wed

Rapaport Melee Auction

New York & Dubai

View Details

October

14-21

Wed-Wed

Rapaport Single Stone Auction

New York & Israel

View Details

October

19-22

Mon-Thu

Israel Diamond Week in New York

New York, NY

View Details

November

11-18

Wed-Wed

Rapaport Single Stone Auction & Buy Now Sale

New York & Israel

Visit Website

QUOTE OF THE WEEK

The U.S. industry needs a coordinated effort to ensure we can protect consumer confidence in our product and have a say on policies that affect the livelihoods of our members.

Ronnie VanderLinden, president of DMIA and newly-formed United States Jewelry Council

MARKETS

United States: Buyers’ market in U.S. as suppliers lower prices. Buyers limiting purchases to fill specific orders, leaving suppliers with large inventories of unsaleable goods...

Belgium: Polished trading is quiet. Dealers report some improvement in European demand following dismal third quarter. Trading is expected to slow through during Diwali holiday...

Hong Kong: Trading is slow with very few orders and no inventory buying. Buyers are cautious and afraid that polished prices will soften further...

India: Trading weak with some U.S. and Israeli buyers “cherry picking” goods before the Diwali break. Steady U.S. demand for SI-I2 clarity diamonds...

Israel: Polished trading improved slightly with conclusion of the Jewish holiday period. Dealers looking to fill specific U.S. orders...

Click here to continue reading

INSIGHTS

Synthetic Diamonds: Legitimize, Don’t Ostracize

Traders of mined diamonds are divided over how to best respond to the growth of laboratory-grown counterparts…

Click here to continue reading

INDUSTRY

Refusals Continue at $200M De Beers Oct. Sight

Sightholders refused about half of their allocated supply at the De Beers October sight, reducing the estimated value of rough sold at the event to $200 million. The move extends a trend of refusals from previous months after De Beers allowed sightholders to defer up to 75 percent of supply in August and restructure their allocations for the following six months.

Still, the mood last week in Gaborone was somber even as sightholders were unsurprised that De Beers kept prices stable. Manufacturing profit margins continue to be squeezed as sightholders feel that the 8 percent to 10 percent rough price cuts in August were not sufficient while polished prices continue to soften.

Rough trading on the secondary market was quiet following the sight with boxes selling at a discount to De Beers list prices – after additional costs such as value-added services and broker fees. Sightholders reduced polished production by 30 percent to 50 percent this year, in line with their lower sales turnover. They note that there are enough goods to supply retailers during the holiday season and are therefore in no rush to raise production or buy rough that they can’t cut at a profit.

Consequently, sightholders expect rough demand to remain low until year end and the miners are adjusting their sales to match this market reality. Okavango Diamond Company only offered diamonds in the 10-plus carat range at its October auction and has canceled its sale in November.

India Boosts Funding to Promote Exports

The government of India increased allocations for export incentive schemes across the economy, including the diamond and jewelry sectors, to $3.2 billion (Rs 21,000 crore) for the current financial year.

Commerce Secretary Rita Teaotia told a meeting of representatives from 27 export promotion councils that the new amount represented an increase to the earlier allocation of $2.8 billion, according to the Gem & Jewellery Export Promotion Council (GJEPC).

She also said the Ministry would take “specific actions” to facilitate exporters’ business and that export promotion councils’ suggestions would be taken into account.

Praveen Shankar Pandya, representing the GJEPC, told the ministry it could combat the exports slowdown in the gem and jewelry sector through a long list of innovations, including presumptive taxation for the diamond sector and free-trade agreements with countries with prohibitive import duties.

WDC President Addresses Synthetics Challenges

ALROSA president Andrey Zharkov told the World Diamond Council (WDC) that the miner has a “function” to “set apart synthetic and natural diamonds” in the supply chain. His speech to the trade body’s annual general meeting focused on the challenges posed by the existence of synthetic stones in the market. Zharkov, who joined ALROSA in April, explained that the Russian group was concerned by the fact that natural diamonds are increasingly being mixed with synthetics.

He said ALROSA was researching fast and effective ways to detect synthetics while supporting initiatives designed to regulate the trade and increase disclosure about the origin of stones. Amendments to Russian federal legislation that were adopted in May are due to take effect in November, requiring jewelry to be labeled if any processing methods have been used to improve a stone’s quality, color or value and to be identified as natural or synthetic. These amendments, according to Zharkov, will make the trade more transparent.

DMIA President to Helm U.S. Representative Jewelry Body

Diamond Manufacturers & Importers Association of America (DMIA) president Ronnie VanderLinden was named as head of the newly formed United States Jewelry Council (USJC), a group established to represent the U.S. industry at both governmental and international levels.

VanderLinden commented that challenges from within and outside the U.S. “are more than an individual association can handle alone. The U.S. industry needs a coordinated effort to ensure we can protect consumer confidence in our product and have a say on policies that affect the livelihoods of our members.”

In addition to the DMIA, the founding participants are: Jewelers of America (JA); the American Gem Society (AGS); the Diamond Council of America (DCA); the Diamond Bourse of Southeast United States (DBSE); the Diamond Dealers Club of New York (DDC); the Indian Diamond and Colored Stone Association (IDCA); the Manufacturing Jewelers & Suppliers of America (MJSA) and the Natural Color Diamond Association (NCDIA). The USJC said these organizations’ combined memberships represent the vast majority of the U.S. jewelry industry.

VanderLinden will serve as president, alongside treasurer David J. Bonaparte, president and CEO of JA; secretary Ruth Batson, CEO of the AGS and CEO James Evans Lombe, director of ethical initiatives for JA.

Indias Polished Diamond Exports -28% in September

Indias polished diamond exports fell 28 percent year on year to $1.92 billion in September 2015, according to provisional data provided by the Gem & Jewellery Export Promotion Council. By volume, polished exports decreased 9 percent to 3.295 million carats. Polished imports decreased 79 percent to $235 million, leaving next exports 8 percent higher at $1.69 billion.

Rough diamond imports decreased 29 percent to $1.05 billion and rough exports fell 55 percent to $67 million, leaving net imports 26 percent lower at $982 million. Indias net diamond account, which is calculated as the difference between net polished exports and net rough imports, rose 198 percent to $706 million compared with a $237 million in September 2014.

During the month, India imported $4.4 million worth of rough synthetic stones, most of them diamonds. Polished synthetic imports, meanwhile, totaled $10.74 million and exports were $6.75 million. In terms of diamond trading for the first nine months of the calendar year,Rapaport News calculated that Indias polished diamond exports fell 9 percent year on year to $16.3 billion, while polished imports decreased 51 percent to $2.70 billion. Net polished exports improved 10 percent to $13.6 billion.

Rough imports decreased 23 percent to $10.378 billion, while rough exports fell 24 percent to $896 million, leaving net imports 23 percent lower at $9.48 billion. Indias net diamond account for the January through September period was $4.08 billion compared with $22 million one year earlier.

Belgium’s Polished Exports Fall 12%

Belgium’s polished diamond exports fell 12% year on year to $1.39 billion in September, according to the Antwerp World Diamond Centre. By volume, polished imports decreased 14% to 610,853 carats, while their average price increased 2% to $2,193 per carat.

Total polished imports to Belgium were also down 12% to $1.34 billion during the month as net polished exports, representing exports minus imports, fell 4% to $47.6 million.

Rough imports decreased 35% to $870.4 million and rough exports fell 38% to $884.5 million. Net rough imports, representing imports minus exports, increased 81% to negative $14.06 million during the month.

Belgium’s net diamond account, representing total polished and rough imports less total exports, decreased 51% to reduce the deficit to $61.7 million.

RETAIL & WHOLESALE

Signet Announces Kay Upgrade, De Beers Deal

Signet Jewelers will rename its Kay Jewelers unbranded products “Kay Now & Forever” and launch 250 new-look Kay store formats by the end of the fiscal year as part of a wide range of holiday-season initiatives revealed in a recent analysts’ report compiled by investment bank Nomura.

The new layouts will include open-entry designs, clear display cases, cleaner lines, no banner advertisement and bright lighting, which Nomura said give “the perception of openness while showcasing the product.”

“Instead of counters that put associates and customers on opposite sides, the store is filled with side-by-side selling counters, which gives customers a sense of partnership with sales associates,” the report’s authors stated, adding that the new-look store “also seems to be aiming for a slightly higher, middle-market jewelry customer.”

Signet will also partner with De Beers on a two-stone diamond campaign under the “Ever Us” brand that will feature diamond pairs with price points ranging from $1,000 to $5,000.

LVMH’s Jewelry and Watch Sales +22%

LVMH Moët Hennessy Louis Vuitton reported an 18% increase in revenue to $28.8 billion (EUR 25.3 billion) for the first nine months of 2015, with its watch and jewelry business jumping 22%. Jewelry and watch sales totaled $2.7 billion for the first three quarters, representing the strongest improvement across LVMH’s business sectors.

The company did not detail what drove the increases, but said its Bulgari jewelry and luxury goods brand had “performed remarkably well, driven by all product categories and all regions of the world.” The Hublot watch brand grew at a high rate and increased its production capacity with the opening of a second plant in Nyon, Switzerland, it said.

LVMH also reported that TAG Heuer’s new smartwatch, created in partnership with Google and Intel, will be unveiled in November.

Chow Tai Fook Sales +4%

Chow Tai Fook Jewellery Group reported a 4% year-on-year increase in retail sales for the second fiscal quarter that ended on September 30, attributing the growth to a surge in demand for gold products and a drop in the metal’s price since mid-July.

The Chinese retailer’s same-store sales for the quarter fell 3% in value terms, but rose 1% in volume terms. It did not disclose figures with the percentages.

The company’s strongest growth was reported in Mainland China, where sales were up 9% by value and 13% by same-store volume, while same-store sales jumped 6%.

Gem-set jewelry sales in the overall business were down 13%, including a 4% drop in Mainland China.

Gold products fared better in both regions, with same-store sales in Mainland China rising 22%. Gold products made up 57% of the company’s total retail sales value, compared with 26% from gem-set jewelry, 13% from platinum and karat gold products and 4% from watches.

Chow Tai Fook opened 16 points of sale during the period, 14 in Mainland China and two in Hong Kong, Macau and other marks.

Zalemark Appoints New CEO

Zalemark Holding Company’s COO, Raymond Ruiz, will replace Steven Zale as CEO, following the veteran designer’s seven-month stint as temporary head of the company.

Zale, who has designed jewelry for more than 30 years, will remain at the company as honorary chairman emeritus, a non-officer, non-director position. He will now concentrate on designing, manufacturing and collaborating with other designers, he explained in a statement.

The company also announced several other appointments: Ernest Martell has been promoted to COO; Caren Currier to secretary and treasurer; Jeff Ringer to executive vice president for marketing and Hie Su Moon to vice president for new business and celebrity development.

Zalemark is “courting several industry icons” to be its president, with Ruiz adopting the role in the interim.

MINING

ALROSA Sees Prices Stabilizing by Year End

ALROSA CEO Andrey Zharkov said the company expects rough diamond prices to stabilize by the end of the year after falling 15%, Bloomberg reported. ALROSA will continue to focus on diamond mining and may review diamond polishing to see if it is beneficial for the company’s value, according to the report.

The group may also start talks with clients on conducting diamond sales in rubles. Diamond prices have declined by about 15% this year, but are still stronger than other commodities, Zharkov told reporters in Moscow.

Rough & Polished reported that ALROSA’s supervisory board had approved the possibility of settling payments in rubles under new export contracts, although these contracts will not be available before 2018 and will not impact current clients. The value of diamonds will still be calculated using the exchange rate set by Russia’s Central Bank and market prices will be listed in U.S. dollars.

ALROSA Unearths 103-Carat Diamond

Russia’s ALROSA has discovered a 102.85-carat diamond with a moderate yellowish hue at its Jubilee kimberlite pipe that is thought to be worth more than $480,000.

The company’s Aikhal Mining and Processing Division found the octahedral-shaped stone in September and reported on its website that it contains small olivine, graphite and sulfide inclusions.

The discovery followed that of a 253.16-carat rough diamond -- worth an estimated $1.5 million to $2 million – found by the same division two years ago at the Jubilee pipe. At the time, the company cited technological advancement at its production facility as the source of its success in recovering exceptionally large stones and avoiding breakages. Six diamonds with weights ranging from 50 to 120 carats have been recovered from the Jubilee pipe this year.

Endiama Chair: Diamonds ‘Not Promoted Enough’

Diamonds are not being promoted enough and as a result, people are not motivated to buy them, according to Carlos Sumbula, the chairman of Angolan state diamond company Endiama.

Speaking in the Angolan city of Saurimo on October 6, Sumbula told a delegation of British Parliament members that diamond producers needed to unite to streamline promotional campaigns for precious stones “so that people feel motivated to buy,” Macauhub reported.

His comments came during the U.K. lawmakers’ visit to Sociedade Mineira de Catoca, the operator of Angola’s largest diamond mine, with both Endiama and ALROSA holding a 32.8% share.

DiamondCorp Delays Sales

DiamondCorp announced it will hold back on selling diamonds until more stones have been accumulated in its inventory, following a poorer performance than expected at its Lace mine in Free State Province, South Africa.

The group said just 4,250 carats of diamonds have been recovered so far at the site, as difficult ground conditions have resulted in slower development in the upper K4 block. DiamondCorp added that larger parcels of diamonds tend to attract stronger prices than smaller ones containing less than 10,000 carats, implying that its decision to wait for more stones to accumulate would help it to achieve better prices.

GENERAL

Manufacturers to Operate at Panama Diamond Exchange

Diamond manufacturers Diarough, Jewelex and Kiran Gems have set up offices at the Panama Diamond Exchange (PDE), marking the launch of Latin American operations. The companies, which pre-reserved space during the construction phase, are also De Beers sightholders.

Diarough, an Antwerp-based manufacturer and wholesaler, appointed Leon Nevedrov to head its office at the hub. Sharon Schwartz will lead Mumbai-based Jewelex’s office and Nathan Abadiwill run Kiran Gems, which is also headquartered in India’s financial ca

CIBJO Releases Coral Guide

CIBJO, the World Jewellery Confederation, introduced an online guide designed to ensure that the coral industry follows ethical business practices and strives for transparency.

Compiled by the CIBJO Coral Commission, the Blue Book outlines acceptable trade practices and nomenclature and provides classifications of non-treated and treated corals and artificial products that imitate or include coral elements.

Coral “is not widely understood” and the guide is an attempt to create “common sets of standards, practices and nomenclature, similar to those which have been created by CIBJO for other sectors,” according to Enzo Liverino, president of the trade groups commission.

IDE Set for Second Polished Fair

The Israel Diamond Exchange (IDE) announced that it will hold its second polished diamond fair on October 28, after deciding to make the event a regular fixture on the bourse’s calendar.

In July, some 60 Israeli diamond companies took part in a first-of-its-kind internal fair in the trading hall that was aimed at increasing the trade in polished goods between members.

IDE vice president and organizing committee chairman Ben-Zion Shasu said the inaugural fair “was widely hailed as a success.”

ECONWATCH

Diamond Industry Stock Report

Industry stocks were mixed in the past week, with U.S. retailers down across the board, led by Walmart (-10%), Nordstrom (-3.7%) and Macy’s (-3.6%). Chinese industry shares continued their October rebound led by Chow Tai Fook (+2.5%) and Luk Fook (+1.5%).

View the detailed industry stock report.

Oct. 15 (13:00 GMT) Oct. 8 (13:30 GMT) Chng.

$1 = Euro 0.88 0.89 -0.010

$1 = Rupee 64.86 65.04 -0.2

$1 = Israel Shekel 3.84 3.85 -0.01

$1 = Rand 13.18 13.42 -0.24

$1 = Canadian Dollar 1.29 1.31 -0.01

Precious Metals

Gold $1,183.25 $1,144.83 $38.42

Platinum $979.50 $948.05 $31.45

Silver $16.10 $15.69 $0.42

Stock Indexes Chng.

BSE 27,010.14 26,845.81 164.33 0.6%

Dow Jones 16,924.75 16,902.93 21.82 0.1%

FTSE 6,333.07 6,355.94 -22.87 -0.4%

Hang Seng 22,354.91 22,354.91 0.00 0.0%

S&P 500 1,994.24 1,995.83 -1.59 -0.1%

Yahoo! Jewelry 1,014.59 1,043.36 -28.77 -2.8%

Múdry sa teší objaveniu pravdy, hlupák falošnosti.

Rapaport Weekly Market Comment October 22, 2015

NY-Israel DDC show successful with motivated sellers giving good prices to buyers filling specific orders. Rising expectations for U.S. holiday sales amid reports of De Beers-Signet “Ever Us” two-stone marketing campaign. China cautious despite better-than-expected 6.9% 3Q GDP growth. Overpriced rough not selling. ALROSA 3Q sales -44% to $563M, volume -36% to 4.9M cts., production +20% to 11.6M cts. De Beers 3Q production -27% to 6M cts. Rio Tinto 3Q production +20% to 4.3M cts. but 2015 production outlook cut 10% to 18M cts. Christie’s NY sells $20M with cushion, 75.56ct., fancy vivid-yellow fetching $3.6M ($47,763/ct.). GJEPC elects Praveen Shankar Pandya as 2016/17 chair.

RapNet Data: October 22

Diamonds 1,267,285

Value $8,426,678,858

Carats 1,378,550

Average Discount -28.61%

www.rapnet.com

The RapNet Diamond Index (RAPI) is the average price for the top 25 diamond qualities (D-H, IF-VS2). It is based on the 10 best priced diamonds for each quality.

Get Current Price List | Subscribe to Rapaport | Join RapNet

RAPAPORT ANNOUNCEMENTS

November

1-4

Sun-Wed

Rapaport Buy Now Sale

Israel

View Details

November

11-18

Wed-Wed

Rapaport Single Stone Auction

New York & Israel

View Details

November

17-25

Tue-Wed

Rapaport Melee Auction

New York & Dubai

View Details

RapNet is Fully Mobile

App now available on iOS and Android.

Download now.

QUOTE OF THE WEEK

With the seasonally strong holiday season approaching, the demand outlook remains uncertain due to the ongoing slowdown in China and a sustained credit squeeze on Indian cutters.

Analysts at VTB Capital, commenting on ALROSA’s October 21 production report

MARKETS

United States: Large crowd at New York Diamond Dealers Club (DDC) Israel Week. More sellers than buyers but event created a buzz and selective buyers got good deals...

Belgium: Sentiment is weak due to slow trading. Global bankruptcy rumors impacting confidence for long-term industry prospects. Dossiers soft as China remains slow...

Hong Kong: Trading is slow as dealers are careful about buying into a down-trending market and businesses close for Chung Yeung public holiday. Demand limited to specific orders...

India: Dealers cautious as demand is below levels usually seen at this time of the year. Far East is quiet. U.S. buying less goods with shift toward branded jewelry...

Israel: Many dealers at NY-DDC event with strong focus on colored diamonds and large stones. Israel relying on U.S. more than ever as China has slowed...

Click here to continue reading

INDUSTRY

Diamond Producers Association Announces Board Appointments

The Diamond Producers Association (DPA) announced the immediate appointments of Jean-Marc Lieberherr as chairman and Stephen Lussier as vice chair. Sally Morrison has been named managing director of marketing.

The DPA was formed by the major diamond mining companies earlier this year to support development in the diamond sector, including within category marketing.

Lieberherr is managing director of Rio Tinto’s diamond business, while Lussier is CEO of the De Beers Group’s Forevermark brand.

Morrison joins the DPA from the World Gold Council, where she most recently served as managing director of jewelry and marketing.

NY Buyers Seek Large, Colored Goods During Israel Diamond Week

Sellers at Israel Diamond Week, being held at New Yorks Diamond Dealers Club (DDC), said that buyers are showing a great deal of interest in colored diamonds and larger-sized goods.

The event has drawn more than 170 exhibitors into the Manhattan DDC offices, including more than 100 from Israel, David Lasher, the DDC’s managing director, told Rapaport News.

"People came ready to buy for the holidays and the momentum of the show is carrying through the week," Lasher said. "The sales are bringing up sentiment in New York."

In addition to colored and large diamonds, Lasher stated that a number of participants said there was more buying than usual of smaller, "American-style goods for retail,” with at least one transaction topping $2 million.

Scholarships Now Available for Range of GIA Programs and Classes

GIA is now accepting applications for more than 200 scholarships for its Gemology and Jewelry Manufacturing Arts programs, courses and lab classes. The aid is sponsored by private donors and the Institute’s endowment fund.

Scholarships are available for distance education eLearning courses and for classes at the GIA’s campuses in Bangkok, Carlsbad, Hong Kong, London, Mumbai, New York and Taiwan; and at the GIA branches in Botswana and Dubai.

Applications for the current scholarship cycle are available now through Oct. 31 at GIA.edu/scholarships.

De Beers Launches Melee Testing Service in India and Belgium

De Beers will offer its melee testing service in Surat, India and Antwerp, Belgium, in the coming weeks, the company announced.

Through its International Institute of Diamond Grading & Research (IIDGR) unit, De Beers will provide verification of the natural diamond content of melee parcels before they are traded. Goods will be returned in sealed, tamper-proof IIDGR packages, with the contents plainly labeled.

Testing will begin in India on October 26 and in Antwerp on November 12

NCDIA Launches Color Diamond Conference Series

The Natural Color Diamond Association (NCDIA) launched a series of conferences around the world to build consumer awareness about the color diamond category. The series kicked off with events in New York on October 2 and Mumbai on October 8 covering rarity, value and natural pink diamonds, and will continue with a conference to be held at the Israel Diamond Institute in November, with the specific date to be announced.

Meetings are also planned for Australia, London, Hong Kong and Antwerp, where additional topics will include the issue of natural versus synthetic diamonds and retailing with color.

RETAIL & WHOLESALE

U.S. Jewelry Prices Rise 1%

The U.S. consumer price index (CPI) for jewelry rose 1.3% in September against the previous month, despite the recent slump in diamond and precious metal prices. The CPI’s reading of 166.20 represented a drop of 2.7% against the previous year.

These results followed reports that U.S. jewelers had increased their prices during the second quarter. Signet Jewelers reported that the average transaction price at its U.S.-based Sterling division rose 4.2% year on year during its fiscal quarter that ended on August 2.

Tiffany & Co. also reported a shift in its sales mix to higher-priced, relatively lower-margin products during its second quarter that ended on July 31.

Still, input costs softened in September, with the Rapaport Diamond Index (RAPI™) for 1-carat, GIA-graded diamonds down 3% (see the Rapaport Monthly Report).

Royal Asscher, Helzberg Introduce Collection

Diamond cutter Royal Asscher and retailer Helzberg Diamonds formed a partnership to introduce a precious stones collection both online and in 40 U.S. Helzberg stores.

The Royal Asscher Brilliant Cut and Royal Asscher Helzberg Diamonds repertoire was shown at an event held in Helzberg’s Kansas City store on September 28, followed by a three-week sales promotional tour across the U.S.

The assortment features Royal Asscher’s signature cuts, the Royal Asscher Cut and the newly introduced Royal Asscher Brilliant Cut, with each ring designed by Lita Asscher. Both cuts were inspired by the 3,106-carat Cullinan diamond, polished by Joseph Asscher in 1908.

Jeweler Valerio Debuts Socially Conscious Brand

Fairtrade activist and U.K. jeweler Greg Valerio introduced a new brand of luxury jewelry touted as being “made from the most socially conscious, environmentally responsible and desirable metals and gems on the planet."

Valerio’s online, ethical jewelry brand offers designs that seek “to create a harmonious and elegant union between the land, the miner, the jeweler and the final customer.” The first collection is a bridal range created from certified Fairtrade gold and silver, traceable diamonds and gemstones.

Hearts On Fire Promotes CMO to President

Diamond brand Hearts On Fire (HOF) announced that two current executive team members will move immediately into new, expanded roles. Caryl Capeci, is now president, from chief marketing officer. Tom Carlo has added the role of chief operating officer to his responsibilities as chief financial officer.

Separately, HOF has named Texas retailer Thomas Markle Jewelers as its 2015 "Retailer of the Year". The jeweler, which operates three stores in the Houston area, was given the award at HOFs University program held in Las Vegas from October 12 to 14.

Grand Jewelers, St. Thomas, U.S. Virgin Islands, was named retail "Rookie of the Year". The three-day program highlighted how retailers should focus on millennials generation and use of social media.

The company was acquired by Chow Tai Fook Jewellry Group in 2014. It recently rolled out a new brand platform and advertising campaign, Ignite Something.

Jarden Acquires Championship Ring Maker Jostens for $1.5B

Global consumer products company Jarden Corporation acquired Jostens, a producer of class, collegiate and sports merchandise and rings, in a $1.5 billion deal.

The purchase, made from investment funds managed by KKR, aPriori Capital Partners and other shareholders, will add a “market-leading, niche consumer brand” to Jarden’s portfolio and bring “best-in-class, customizable production capabilities in printing, jewelry and apparel,” according to the corporation’s announcement.

Tiffany & Co. Online Campaign Targets Chinese Consumers

Tiffany & Co. is targeting consumers in China through videos posted on Chinese websites rather than on YouTube.

The Chinese language campaign, shown without subtitles, is said to be a first for the retailer. As reported by Luxury Daily, Tiffany will likely promote the campaign on other language social media networks to ensure crossover success.

The campaign’s two ambassadors are Chinese supermodel Liu Wen and Taiwanese director and actress Sylvia Chang.

Webinar to Help Jewelers Market to Same-Sex Couples

Retail jewelers looking to boost their sales to same-sex couples shopping for engagement and wedding jewelry are the target audience for a November webinar.

Jewelry manufacturers group The Plumb Club is sponsoring the online event on November 4 at 2 p.m. EST. The 45-minute program will focus on protocols within LGBT engagements and weddings, increased demand for jewelry by same-sex couples and the subtleties of marketing to same-sex couples.

Earlier this year, Tiffany & Co. included a photo featuring a same-sex couple in an advertising campaign, marking a first for the brand.

Panelists at the webinar will include: Bernadette Smith, founder and president of the Gay Wedding Institute; Rony Tennenbaum, a designer specializing in contemporary wedding jewelry who writes about emerging LGBT nuptial practices; and Matthew Perosi-Doughty, a business services consultant to jewelers who founded Jewelers Equality Alliance.

Analysts ‘Cautiously Optimistic’ on Holiday Retail

Equities analysts at Nomura Securities are expecting a 2.5% to 3% comparable holiday sales increase for the North American specialty retailers that they track, according to a presentation it sent investors on October 20.

“Heading into this holiday season, we are cautiously optimistic that retail sales will be healthy,” the presentation stated. “We are generally encouraged by recent macro trends” and “believe consumers are entering this holiday season with extra cash in their pockets.”

This year’s holiday calendar has an extra day compared with 2014, for a total of 28 selling days between Thanksgiving and Christmas. That extra day is worth about one sales percentage point for the period versus 2014, the analysts wrote.

NRF Expects 4% Year-End Sales Increase

The National Retail Federation (NRF) is projecting that overall sales in November and December could grow 3.7% year on year to $631 billion.

Over the past decade, holiday sales have grown 3.1% on average and holiday sales can account for as much as 30% of a retailer’s annual sales.

The NRF also expects seasonal employment to add as many as 750,000 jobs to the U.S. economy this year compared with more than 714,000 last holiday s

MINING

De Beers 3Q Production Drops 27%

De Beers rough diamond production fell 27 percent year on year to 6.012 million carats during the third quarter following a decision to reduce output “to better reflect current trading conditions.”

The company has seen a sharp drop in rough sales in 2015 as demand from China slowed resulting in a backlog of polished diamond inventory held by diamond manufacturers.

In August, De Beers lowered its full-year production guidance to between 29 and 31 million carats and on October 22 said it now expects output to be at the lower end of that estimate. Production for the first nine months of the year is down 11 percent to 21.64 million carats.

The bulk of the third quarter decline came from Debswana, De Beers mining joint venture with the Botswana government, where output dropped 35 percent to 4.074 million carats. Planned maintenance at the Jwaneng and Orapa mines is being prioritized in light of current trading conditions, while there is also a focus on waste mining and processing lower grade material at Jwaneng, Anglo American explained. Production at Jwaneng, considered De Beers flagship mine, slumped 42 percent to 1.936 million carats during the quarter.

ALROSA Sales Slump as Production Spikes

ALROSA’s diamond sales fell 44% year on year to approximately $563 million during the third quarter of 2015, according to the miner’s preliminary trading report.

Despite these sales declines, ALROSA increased its production by 20% to 11.635 million carats during the third quarter, marking its highest quarterly output in at least seven years or since production data was officially made available, according to Rapaport records.

The company confirmed its stated full-year production guidance of 38 million carats.

Dominion’s Diavik Production -15%

Dominion Diamond Corporation saw a 15% year-on-year drop in diamond processing at its Diavik Diamond Mine to 480,000 tons during the third quarter.

The decrease resulted from the fact that additional stockpile was available and processed during the comparable quarter of 2014 but fully exhausted by the end of that calendar year, as well as the drop in ore availability caused by poor ground conditions, according to Dominion. Average prices of the company’s own production were down 24 percent to $1,791 per carat.

The company expects its full-year production target to be 2 million tons mined, 2 million tons processed and 6.8 million carats, with mining activities to be conducted exclusively underground.

Dominion owns 40% of the mine and the remaining 60% stake is owned by Rio Tinto.

Rio Tinto Delays Cuts Production Forecast

Rio Tinto placed final product processing at its Argyle mine on hold in response to market conditions and as a result, reduced its forecast of annual share of diamond production for 2015 from 20 million carats to 18 million carats.

The development follows a 20.5 percent increase in the miner’s diamond production to 4.275 million carats during the third quarter that ended on September 30. The company attributed most of the increase to a 43.1% jump in production at Argyle to 3.514 million carats, while production at Diavik fell 24.2% to 761,000 carats.

The group said the main focus at Argyle had been the ramp-up of production from the underground mine, while at Diavik, lower processing volumes and lower recovery grades from led to the production drop.

Rio Tinto owns all of the Argyle mine in Western Australia and 60 percent of Diavik.

Kennady Mine Valuation on Par With World’s Highest-Margin Diamonds

Kennady Diamonds’ Kelvin mine in Canada’s Northwest Territories was determined to contain diamonds valued at $123 per carat on average, comparable to the world’s highest-margin diamonds. Three of the highest-value diamonds in the sample included a 4.22-carat stone with a value of $1,603 per carat; a 2.58-carat gem valued at $1,366 per carat and a 2.38-carater assessed at $1,196 per carat.

The price assessment, conducted by WWW International Diamond Consultants, was based on gems weighing 989 carats and recovered from a bulk sampling of Kelvin mine kimberlite, Kennady stated, adding that “it is encouraging to see so many good-color white gemstones, especially in the C sample, with five of the eight stones being good color and gem quality.”

“Kelvin diamond prices are comparable to those from the neighboring Gahcho Kué mine, when the rough diamond price index was at a comparable level,” Patrick Evans, Kennady’s president and CEO, said. “This is very encouraging, particularly as Gahcho Kué is widely recognized as the world’s highest-margin, new-diamond mine.”

Ellendale May Be Handed Back to the State

The collapsed Ellendale diamond mine may be handed back to the local government as the diamond market implodes, according to a report by daily The West Australian.

A fresh dispute is looming over the collapsed Ellendale mine as liquidators try to offload its mining tenements and resolve a $28 million environmental liability into the state government’s Mining Rehabilitation Fund.

Owner Kimberley Diamonds closed operations at the mine earlier this year after repeated late payments of royalties. In January, Western Australia’s Department of Mines and Petroleum (WADMP) set in motion a forfeiture action over Kimberley’s failure to pay $200,000 in tenement rental for the mine’s lease.

Rockwell’s Revenue Rises Following Beneficiation Deal

Rockwell Diamonds reported that revenue rose 32% year on year to $17.3 million (CAD 22.3 million) during its second quarter that ended on August 31, driven by its beneficiation partnership with New York-based diamond manufacturer Diacore. Rockwell’s rough diamond sales fell 14% to $9.5 million, but the miner swung to a $1.9 million profit for the period from the $1.2 million loss it posted one year earlier.

The company’s beneficiation income nearly quadrupled to $7.8 million. Under its agreement with Diacore, Rockwell is entitled to 50% of the profits derived from the sale of polished diamonds produced by Rockwell and sold through Diacore.

With diamond markets depressed this year, CEO James Campbell noted in the report that diamond manufacturers have closed their factories rather than manufacture unprofitable rough. He added that open-market rough and polished prices seem to have bottomed out, though the company expects rough prices to stabilize as polished diamond demand is expected to improve over the U.S. Christmas shopping season.

Rockwell’s average rough price rose 20% to $1,783 per carat during the second quarter. Average prices of the company’s own production were down 24% to $1,791 per carat.

Mountain Province Hires Rio Tinto Marketing VP