Rapaport Weekly Market Comment September 11, 2015

Market focused on Hong Kong show. Manufacturers and dealers looking for liquidity amid low expectations. Great opportunity for buyers. Some dealers not attending show due to Jewish and Jain holidays. Chinese wedding demand stable but luxury purchases have been put on hold due to weak economy and stock markets. Rough trading slow as ALROSA expected to reduce prices by about 10% next week. Catoca mine 2014 production -2% to 6.5M cts., sales +1% to $603M. Belgium Aug. polished exports -29% to $341M, rough imports -45% to $606M. U.S. July polished imports +2% to $2.2B, polished exports -9% to $1.4B. Best wishes to all for a happy, healthy and prosperous Jewish New Year.

RapNet Data: September 10

Diamonds 1,356,686

Value $8,763,890,650

Carats 1,416,982

Average Discount -26.33%

www.rapnet.com

The RapNet Diamond Index (RAPI) has been revised to reflect the average price of the 10 best priced diamonds in each category.

Get Current Price List | Subscribe to Rapaport | Join RapNet

RAPAPORT ANNOUNCEMENTS

September

10-24

Thu-Thu

Rapaport Melee Auction

New York & Hong Kong

View Details

September

16-22

Wed-Tue

Hong Kong Jewellery & Gem Fair

Rapaport Booth: AWE 7N33

Hong Kong

View Details

October

13-21

Tue-Wed

Rapaport Melee Auction

New York & Dubai

View Details

October

14-21

Wed-Wed

Rapaport Single Stone Auction

New York & Israel

View Details

QUOTE OF THE WEEK

While making the decision to close stores is difficult, we know it is necessary for us to remain competitive as customer shopping patterns continue to change.

Terry J. Lundgren, Macy’s, Inc. chairman and CEO | As the retailer announced plans to close 35-40 underperforming Macy’s stores in early 2016.

MARKETS

United States: Trading in New York has softened as dealers note it’s difficult to find the right goods. Buyers are looking for deals but are dissatisfied with the quality of diamonds available at the moment.

Belgium: Sentiment improved in Antwerp as dealers returned from their August vacations. There is steady, but selective European and U.S. demand, while the Far East remains relatively quiet.

Hong Kong: Polished trading remains quiet and dealer expectations for next week’s show are muted.Jewelers are maintaining rather than increasing their stock levels as China’s retail expansion slows.

India: Polished trading in Mumbai is relatively quiet and sentiment is weak as liquidity is tight. Overseas buyers are looking for goods but finding shortages in some categories, such as pique goods for the U.S. market.

Israel: Sentiment improved after the International Diamond Week in Ramat Gan but expectations are still low for the Hong Kong show. Dealers note a challenging market; there is activity and orders for select goods are being made.

Click here to continue reading

INDUSTRY

Belgium’s Polished Exports Drop

Belgium’s polished diamond exports fell 29% year on year to $341.2 million in August, according to the Antwerp World Diamond Centre. By volume, imports dropped 16% to 185,971 carats, while their average price was down 16% to $1,835 per carat.

Among Belgium’s main trading partners, polished exports to the U.S. slumped 48%, those to Hong Kong fell by 14% and exports to Switzerland plunged 59%.

Total polished imports to Belgium declined 17% to $694.6 million during the month as net polished exports, representing exports sans imports, slid 1% to negative $353.3 million.

Rough imports dropped 45% to $605.9 million and rough exports fell 36% to $432.4 million, mirroring the slump in global rough trading that was evident during the month.

U.S. Polished Imports Edge Up

Polished imports to the U.S. increased 2% year on year to $2.18 billion in July, according to data published by the U.S. Commerce Department. By volume, imports fell 12% to 918,859 carats, while their average price increased 16% to $2,375 per carat.

Polished exports fell 9% to $1.41 billion and net polished imports – calculated by subtracting exports from imports – grew 32% to $777 million.

Rough imports dropped 28% to $33 million and rough exports slumped 47% to $9 million during the month. Net rough imports slid 16% to $24 million.

DMCC Unveils Burj2020 District

The Dubai Multi Commodities Centre (DMCC) unveiled its “Burj2020 District,” a mixed-use urban center. The new area, introduced at the 2015 Cityscape Global Conference, will include several towers and total more than 1 million square meters.

Adrian Smith, a partner at design firm AS+GG, said the concept driving the district’s design was inspired by the facets of a diamond, which are “elegant, bold and timeless.”

In addition to commercial space, the district will offer 100,000 square meters of retail space and serve the surrounding DMCC Free Zone and Jumeirah Lake Towers.

October Israel Diamond Week Set for NY

Israel Diamond Week in New York is scheduled for October 19-22. This will be the fourth time the Israel Diamond Exchange (IDE) and the Diamond Dealers Club of New York (DDC) are partnering on the event to be held on the DDC’s trading floor, 580 Fifth Avenue in midtown Manhattan.

IDE President Shmuel Schnitzer said that following the positive business results of the recently held International Diamond Week in Israel, he has high expectations of the event, anticipating 100 bourse members will participate.

DDC President Reuven Kaufman said that since the joint initiative came about four years ago, business ties between members have improved tremendously. "While the synergy between Israels and New Yorks diamond trade is a given, there is always room for further business development and higher business volumes."

RETAIL & WHOLESALE

Macys to Close as Many as 40 Stores

Macys Inc. will close 35 to 40 underperforming Macys stores – representing approximately 1 percent of total sales – in early 2016. Together, the stores annual sales volume, or net of sales expected to be retained in nearby stores and online, is estimated to represent roughly $300 million.

Over the past five years, Macys has closed 52 stores and opened 12 new ones.

China’s New Import Laws to Boost Retail

Duty-free and travel-related retail sales in China could receive a boost from government plans to change tax rules and build more retail venues, according to Bloomberg Intelligence analyst Catherine Lim.

The government is expected to incorporate these changes into its thirteenth five-year plan, to be released later this year.

According to Lim, Chinas new airports and seaports, along with downtown duty-free shops, may add selling space for luxury brands. Reforming the state-owned companies that control the countrys duty-free shopping industry could draw foreign firms into partnerships, Lim predicted.

Nirav Modi Opens First U.S. Store in N.Y.

India’s Nirav Modi brand is set to launch its first U.S. store in New York. The opening will spotlight the Maharani Diamond Necklace and Earrings, a $1.65 million diamond set composed of five graduated rows of diamonds weighing over 230 carats and set in 18-karat white gold.

The Maharani will be displayed in the store’s window at the corner of 64th Street and Madison. The diamond assortment took more than two years to source.

Modi, a third-generation diamantaire and the chairman and managing director of Firestar Diamond, began working in the diamond industry when he was 19 years old and eventually began curating and crafting fine jewelry. Modi’s pieces are regularly featured in major global auctions, including Sotheby’s and Christie’s. Forbes magazine recently listed the billionaire as the 63rd richest man in India.

New NAJ Campaign Emphasizes Ethics

The U.K.’s National Association of Jewellers (NAJ) unveiled its new official logo at the International Jewellery London show this week to highlight an industry-wide ethical code reflecting both inclusivity and consumer confidence, Professional Jeweller reported.

The new logo is based upon the National Association of Goldsmiths (NAG) coat of arms, featuring St. Dunstan, the patron saint of goldsmiths.

The NAJ will also offer a consultation process at the show, enabling industry members to provide comments and feedback on its code of conduct prior to implementation. Details of the consultation and access to the draft code can be found at www.naj.co.uk/codeofconduct.

EZcorp Buys 13 USA Pawn Locations

U.S.-based pawn shop operator EZcorp Inc. has completed the acquisition of 13 USA Pawn and Jewelry Co. pawn stores located in Arizona and Oregon for $12.5 million in cash.

EZcorp provides pawn loans in the U.S. and Mexico and consumer loans in Mexico. The company’s stores also sell merchandise, primarily collateral forfeited from pawn-lending operations and used merchandise purchased from customers.

Graff Fall Advertising Features Jewels In Natural Elements Theme

Jeweler Graff’s autumn advertising campaign presents some of its finest diamonds in four images themed around the elements of earth, water, air and fire, according to Professional Jeweller.

The campaign kicks-off this month across newspapers, magazines, ambient media and online platforms – with images also displayed in-store at Graff’s 55 locations across U.K. and Europe, North America, Africa, Asia and the Middle East.

Model Emily Didonato was shot by Michelangelo Battista wearing a total of 470 carats of diamonds, rubies and emeralds across the four images.

Tiffany to Receive Costcos Earnings on Mislabeled Tiffany Rings

Tiffany & Co. is entitled to Costco Wholesale Corp.’s earnings from the sale of engagement rings mislabeled as Tiffany rings at Costco stores, Judge Laura Taylor Swain ruled. The luxury jeweler is also entitled to punitive damages under New York State law.

The court further found that Costco was liable for trademark infringement and trademark counterfeiting in its use of the “Tiffany” name on signs in jewelry cases at Costco stores to describe certain engagement rings that were not made by Tiffany & Co.

The court denied Costcos claim that “Tiffany” is a generic term for a pronged ring.

Charles & Colvard Introduces Branded Colorless Moissanite

Retailer Charles & Colvard, Ltd. is expanding its moissanite product line with the addition of Forever One, the companys first colorless (D-E-F) grade of the lab-grown gemstone. They are marketed as socially responsible and available at a fraction of the cost of diamonds.

"Forever One is a game changer for the jewelry industry, its the most superior moissanite I have ever seen," said Marvin Beasley, president & CEO. The gemstone have a hardness of 9.25 and refractive index of 2.65 to 2.69, according to a company announcement.

The synthetic moissanite gemstone comes with a certificate of authenticity and a limited lifetime warranty from the retailer.

JVC Site Redesign Aimed at Better Legal Compliance

With its redesigned website, the Jewelers Vigilance Committee (JVC) is seeking to make it easier for users meet their legal obligations and maintain consumer confidence.

The site, www.jvclegal.org, has been designed to enable more intuitive searches in all areas, including on organization membership, industry-related compliance, breaking news and updates. The group has also simplified product purchasing and program registration.

“JVC’s mission is to promote ethics and integrity in our industry by ensuring legal compliance,” said president and CEO Cecilia Gardner. “The most effective way to do that is to provide information and education to the trade. Our new, upgraded website promotes that effort by making it easier to find the information people need to meet their legal obligations and maintain consumer confidence.”

MINING

ZDTC Chair Urges Zimbabwe to Curb Rough Exports

Zimbabwe Diamond Technology Centre (ZDTC) chairman Lovemore Kurotwi declared that the country was losing millions of dollars through the exportation of rough diamonds, according to the government-run newspaper The Herald.

“It is now time that the government stopped exportation of rough diamonds and seriously considered issues to do with value addition,” Kurotwi was quoted as saying. “Currently, we are exporting several jobs and we are only getting just a quarter of what we are supposed to realize from our diamonds. We have no justification for not venturing into value addition because we now have the latest technology in the country and we also have highly educated and skilled manpower.”

Rough diamonds are traded to both local and international buyers through a tender system, a situation Kurotwi described as putting local buyers at a disadvantage in that they are usually pushed out of business by foreign dealers with “mighty financial muscles.”

“We want the government to ensure a consistent supply of diamonds to local dealers, who will in turn create employment for local people at the same time, bringing in much-needed foreign currency,” he stated.

Lucara Sets November Exceptional Stone Tender

Lucara Diamond will hold its second exceptional stone tender this year in November, the company announced. Viewing will take place in Gaborone from November 2 through November 11, 2015 with the tender closing at 4.00 p.m. CAT.

The tender will feature as many as 12 diamonds including the recently recovered 336-carat Type IIa diamond as well as an 8 carat fancy pink diamond.

"The Karowe Mine continues to deliver as expected allowing us to have a second exceptional stone tender in 2015,” William Lamb, president and CEO, said. “The increase in bottom cut-off value to $1.0 million for qualifying diamonds for the exceptional stone tenders has resulted in less stones being available for these tenders but has increased the value for Lucara by allowing us to offer higher quality at our regular tenders. The recovery of colored stones from the south lobe is very encouraging as no colored stones have previously been identified from this lobe."

DiamondCorp to Sell First Lace Mine Diamonds

DiamondCorp’s first sale of diamonds from its Lace mine in South Africas Free State has been scheduled for October, by which time tunnel and initial slot drive tonnage will have provided a sufficiently representative parcel of kimberlite diamonds, according to Mining Weekly.

The proceeds from the initial diamond sales, along with controlled bulk test results from the kimberlite tunnel development, are expected to provide the information required for the release of an updated resource statement.

Vladivostok Diamond Exchange in the Works

In the process of establishing a diamond exchange in Vladivostok, the Russian government is studying the experience of the Shanghai Diamond Exchange, Deputy Finance Minister Alexei Moiseyev told Interfax at the Eastern Economic Forum.

A session at the forum devoted to the development of the rough and cut diamond business in the Asia-Pacific region discussed the “opportunities provided by the Vladivostok Free Port [which will obtain free port status this year] in terms of the removal of administrative barriers,” Moiseyev said.

He explained that “one window” is needed to bring together all of the agencies that regulate diamond exports, including the Assay Chamber and customs, and to accelerate transactions between market participants.

Deputy Prime Minister Yury Trutnev, who is also the presidential envoy to the Far East Federal District, said a diamond exchange could be established in Vladivostok to facilitate the localization of transactions with rough diamonds in Russia.

ALROSA head Andrei Zharkov told reporters that the positive experience of Indias cutting industry and leading jewelry retailer China should be used in the establishment of a diamond exchange in Russia. "The government is willing to hear and support our proposals," he said.

North Arrow Confirms High Diamond Counts at Saskatchewan Project

North Arrow Minerals reported new microdiamond results from the PK150 and PK312 kimberlites and confirmed the discovery of a new kimberlite PK311 located within the Pikoo Diamond Project in central eastern Saskatchewan, according to a company announcement.

The results come from drill core samples recovered during the spring 2015 exploration drilling program.

Ken Armstrong, president and CEO of North Arrow, said "These new diamond results from PK150 are consistent with those reported from the 2013 discovery drill holes and confirm PK150 as a significantly diamondiferous kimberlite with increasing size potential located less than 20km from road and power infrastructure in Saskatchewan."

He said planning is underway for a detailed follow up program in advance of a winter drilling program to further delineate PK150 and the other kimberlites on the property, as well as to test new targets.

Catoca’s Diamond Sales Rise

Catoca, which operates Angola’s largest diamond mine, reported that its sales rose 1 percent to $602.9 million in 2014. The average price achieved from its sales increased 3 percent to $92.66 per carat during the year, while sales volume grew 1 percent to 6.641 million carats.

Production at the Catoca mine fell 2 percent to 6.456 million carats, accounting for 76 percent of Angola’s total diamond production by value and 47 percent by volume, the company reported.

Catoca’s president, José Manuel Augusto Ganga Jύnior, stated in the annual report that Angola’s diamond sector had benefited from stable diamond prices in 2014, while the country had boosted its profile by holding the chairmanship of the Kimberley Process Certification Scheme and reopening a cutting factory.

GENERAL

Israel Diamond Industry Preps for Anti-Money-Laundering Regulations

Israel Diamond Exchange (IDE) members will soon be subject to government supervision of cash payment policies under new anti-money-laundering regulations, according to state Diamond Controller Shmuel Mordechai, the IDE reported.

The first part of the new policy takes effect on September 15 and by mid-October, IDE members will be subject to supervision by the controller’s office, “especially in the field of client identification,” Mordechai said. “At first, we will help people to understand and adapt their business, but if we detect any irregularities, we will treat them severely.”

Representatives of Israel’s Money Laundering and Terror Financing Prohibition Authority will conduct periodic checks of IDE members. In addition, every bourse member company must appoint a point-person to explain the new cash payment policies to the company’s employees.

The purchase and sale of synthetic diamonds will also be subject to the new regulations.

Rajesh Secures $168M Jewelry Order

Indian jewelry firm Rajesh Exports has received a $168 million (Rs 11.23 billion) export order from Singapore for diamond and gold-studded jewelry, news agency PTI reported.

The firm said the order will be finished by December. In June, it secured a $194 million order from a company based in the United Arab Emirates, which is slated to be finished this month.

The company has a jewelry manufacturing unit at Bangalore with a gold-to-jewelry processing capacity of 250 tons. It also markets Shubh Jewellers-branded jewelry and has 83 showrooms across India.

Chow Tai Fook Offers Transformed Cullinan Diamond

Hong Kong-based jewelry retailer Chow Tai Fook debuted “A Heritage in Bloom” by world-renowned jewelry artist Wallace Chan. The piece was created using 24 D-color, internally flawless diamonds cut from the Cullinan Heritage, a rare, 507.55-carat Type IIa rough diamond that is almost devoid of impurities.

The diamond necklace, a modular design, unites thousands of white diamonds and hundreds of pink diamonds, totaling 383.4 carats, as well as more than 100 pieces of green jadeite and mutton fat white jade. The piece required over 47,000 man hours and can be worn 27 different ways. The centerpiece of the necklace is the largest diamond in the collection: a 104-carat, D color, internally flawless, brilliant round with the highest possible cut grade of “3-Excellent,” making it one of the largest diamonds ever to possess these characteristics.

Chow Tai Fook, one of the world’s largest retail jewelers by market value, said it paid $35.3 million for the 507-carat rough diamond in 2010 and spent three years cutting and polishing it.

Bonhams to Auction Hope Diamonds ‘Cousin’

The Hope Spinel, a 50.13-carat spinel stone once owned by banker Henry Philip Hope, will be put up for auction later this month by Bonhams London. The spinel hasnt been available for 98 years, according to the auction house, and will be offered for an estimated $240,000 to $310,000 during the Bonhams London Fine Jewellery sale to be held later this month.

The bankers wide collection contained some 700 gems before his death in 1939, including the famous Hope Diamond, which is now housed at the National Museum of Natural History in Washington, D.C.

“You just dont see pieces of this quality and provenance on the open market very often. Its very exciting,” Bonhams representative Emily Barber said.

Gemfields Reports Strong Results from Singapore Kagem Emeralds Auction

Miner Gemfields said results from its recent auction held in Singapore met expectations. The gems were extracted by Kagem Mining, which is 75% owned by Gemfields and 25% by the government of Zambia, according to a report by StockMarketWire.com.

The auction also included higher quality amethyst from Kariba Minerals Ltd in which Gemfields has a 50% interest, with the balance also belonging to the government of Zambia.

A total of 37 companies placed bids in the first Gemfields auction of the current financial year. The auction followed 7 successive emerald auctions held in Lusaka, and marked the return of Zambian emerald auctions to the broader international market.

The auction saw 600,000 carats of higher quality emeralds extracted from Kagem offered, with 18 of the 19 lots offered being sold, generating revenues of $34.7 million. The auction realized an overall average value of $58.42 per carat, the third-highest figure on record, according to the report. The companys 19 auctions of emeralds and beryl mined at Kagem since July 2009 have generated $360 million in total revenues.

Panama Bourse Head Ackerman Moving to Jewelry Hub Role

Erez Akerman is stepping down at the end of October as president of the Panama Diamond Exchange (PDE) to take on the role of managing director of the World Jewelry Hub, according to a PDE announcement.

Akerman has served as PDE president since its founding in 2008. As managing director, he will shift his focus to the next stage of development of the Jewelry Hub, the construction of a multi-story office tower and business center in Latin Americas only dedicated gemstone and jewelry trading hub. A successor as PDE president will be named during the coming weeks.

STATS

U.S.

July 2015 $Mil. % Chng. YTD 2015 $Mil % Chng.

Polished Imports $2,182 2% $14,428 1%

Polished Exports $1,405 -9% $11,566 -11%

Net Polished Imports $777 32% $2,861 118%

Rough Imports $33 -28% $150 -64%

Rough Exports $9 -47% $83 -69%

Net Rough Imports $24 -16% $67 -54%

Net Diamond Account $801 30% $2,928 101%

Belgium

August 2015 $Mil. % Chng. YTD 2015 $Mil % Chng.

Polished Exports $341 -29% $8,832 -6%

Polished Imports $695 -17% $8,841 -5%

Net Polished Exports $(353) -1% $(9) N/A

Rough Imports $606 -45% $7,738 -24%

Rough Exports $432 -36% $7,853 -26%

Net Rough Imports $174 -59% $(114) 74%

Net Diamond Account $(527) 31% $106 -83%

ECONWATCH

Diamond Industry Stock Report

Industry stocks were mixed in the past week, generally tracking their respective indexes. In the U.S., JC Penney (+3.4%) was the notable gainer. Charles & Colvard (-7.5%) and Movado (-4.5%) led decliners. Chow Sang Sang (+6.2%) led advances in the Far East, along with Chow Tai Fook (+4%). India’s Rajesh Exports dropped (34.5%) despite news of a large customer order.

View the detailed industry stock report.

(Prices as of 08:30 GMT) Sept. 10 Sept. 3 Chng.

$1 = Euro 0.8933 0.8898 0.003

$1 = Rupee 66.5304 66.1905 0.3

$1 = Israel Shekel 3.8979 3.9288 -0.03

$1 = Rand 13.8406 13.4936 0.35

$1 = Canadian Dollar 1.3217 1.3263 0.00

Precious Metals

Gold $1,107.90 $1,130.15 -$22.25

Platinum $990.60 $1,013.05 -$22.45

Silver $14.76 $14.71 $0.05

Stock Indexes

BSE 25,463.55 25,815.88 -352.33

Dow Jones 16,253.57 16,351.38 -97.81

FTSE 6,187.33 6,196.06 -8.73

Hang Seng 21,562.50 20,934.94 627.56

S&P 500 1,942.04 1,948.86 -6.82

Yahoo! Jewelry 1,007.45 1,009.15 -1.70

Múdry sa teší objaveniu pravdy, hlupák falošnosti.

Rapaport Weekly Market Comment September 18, 2015

Positive mood at important Hong Kong show which is exceeding seller expectations. Dealer and retailer demand is price sensitive with strong focus on SI-I1 goods for the U.S. market and top grade 3X cut quality. Manufacturers maintaining reduced (-30% to -50%) polished production through Nov. Diwali season. ALROSA cuts rough prices 8%-10%, allows 50% deferrals at Sept. sale. Dominion 2Q revenue -24% to $210M, loss of $19M vs. profit of $27M a year earlier. Gem Diamonds sells 357ct. Letšeng rough diamond for $19M (~$54,000/ct.). India’s Aug. polished exports -8% to $1.8B, rough imports -22% to $610M. UAE appointed 2016 Kimberley Process chair.

RapNet Data: September 17

Diamonds 1,321,787

Value $8,688,037,141

Carats 1,405,830

Average Discount -27.90%

www.rapnet.com

The RapNet Diamond Index (RAPI) has been revised to reflect the average price of the 10 best priced diamonds in each category.

Get Current Price List | Subscribe to Rapaport | Join RapNet

RAPAPORT ANNOUNCEMENTS

September 10-24 Thu-Thu

Rapaport Melee Auction

New York & Hong Kong

View Details

September 16-22 Wed-Tue

Hong Kong Jewellery & Gem Fair

Rapaport Booth: AWE 7N33

Hong Kong

View Details

October 13-21 Tue-Wed

Rapaport Melee Auction

New York & Dubai

View Details

October 14-21 Wed-Wed

Rapaport Single Stone Auction

New York & Israel

View Details

QUOTE OF THE WEEK

Like everyone, we’re waiting to see what the Christmas season will be like. If things don’t improve, we’ll have to go back to the drawing board and rethink our strategy.

Jacob Thamage, Botswana’s Diamond Hub program coordinator

MARKETS

United States: Trading activity was subdued in the Diamond Dealers Club of New York with most businesses closed Monday and Tuesday for the Jewish New Year. The local trade is waiting to gauge price and demand trends at the Hong Kong Show.

Belgium: Antwerp was also quiet due to the Jewish New Year and with many dealers in Hong Kong. Opinion was undecided at press time whether the show will signal an improvement in Far East demand and trigger better global trading.

Hong Kong: Initial reports signaled that the show was better than expected in the opening days. There was steady traffic although fewer Chinese and Indian buyers were reportedly in attendance than in previous years.

India: Local trading was slow during Paryushan, which ran from September 10 to 17. Fewer dealers traveled to the Hong Kong show because of the festival but some are expected to make the trip over the weekend.

Israel: Like in New York and Antwerp, Ramat Gan trading was quiet with the bourse closed for the Jewish New Year holiday. Fewer Israelis exhibited at the Hong Kong show than in past years but there is still a sizeable delegation in the Israel Diamond Institute’s pavilion.

Click here to continue reading

INSIGHTS

Blinging Down Botswana’s Economy

It’s a long way from New York’s Madison Avenue advertising agencies to Gaborone, but for Botswana a lot is riding on the success of the ad campaign De Beers will launch in the coming weeks...

Click here to continue reading

INDUSTRY

India’s Polished Exports Dip

India’s polished diamond exports fell 8% year on year to $1.76 billion in August, according to provisional data published by the Gem and Jewellery Export Promotion Council (GJEPC). The volume of exports dropped 21% to 2.835 million carats as the average price declined 6% to $619 per carat.

Polished imports, meanwhile, slumped 53% to $241 million during the month. Net polished exports, calculated by subtracting imports from exports, rose 8% to $1.51 billion.

Rough imports dropped 22% to $610 million in August, while rough exports fell 24% to $88 million. India’s net rough imports, or the excess of imports over exports, declined 22% to $522 million, representing the amount of goods that stayed in the country for manufacturing.

During the first eight months of the year, India’s polished exports fell 6% to $14.34 billion, while polished imports declined by 44% to $2.47 billion. Net polished exports, however, rose 10% to $11.87 billion.

Rough imports dropped 23% to $9.33 billion and rough exports slid 19% to $829 million in the eight-month period. Net rough exports declined 23% to $8.5 billion.

De Beers IIDGR to Offer Synthetic Melee Testing in India

De Beers International Institute of Diamond Grading & Research (IIDGR) plans to introduce a low-cost, high-volume synthetic melee screening and referrals testing service in India next month.

The new service will use IIDGR’s proprietary technology to support the wider Indian industry in the detection of undisclosed synthetic diamonds.

“India is the world’s largest center for diamond cutting and polishing,” said Jonathan Kendall, president of IIDGR. “Launching a new low-cost, high-volume service in India for screening synthetic melee and testing referrals will support both trade and consumer confidence as more businesses will be able to use our technology to provide greater assurance to their customers.”

UAE Appointed KP Chair for 2016

The United Arab Emirates (UAE) has become the first Arab country to take up the position of Kimberley Process (KP) chair, effective in 2016.

The Dubai Multi Commodity Centre (DMCC) and the UAE Economic Ministry’s authority for the Kimberley Process Certification Scheme welcomed the appointment, which was confirmed by a vote.

The UAE will use this opportunity to focus on the areas with the greatest impact on the growth and development of the diamond industry, according to a DMCC statement. These areas include expanding the reach of the KP and bringing the flow of conflict diamonds to an end globally, while strengthening ties between the three pillars of the KP (government, industry and civil society).

The UAE is also expected to emphasize the importance of providing assistance to newly admitted countries with technical matters, training and consensus building.

Ex-Kimberley Diamonds Boss Arrested

Alexandre Alexander, the former head of Australian-based mining company Kimberley Diamonds, was arrested by the Australian Securities and Investments Commission (ASIC) on charges of misleading the stock market, Australian Broadcasting Corp. reported.

Alexander, 48, who is also known as Alexandre Dergouchine, has been charged with four counts of making false and misleading statements to the Australian Securities Exchange (ASX) between October 2013 and March 2014. Each charge carries a maximum penalty of five years in jail and a $34,000 fine.

ASIC is alleging that Alexander authorized market statements which failed to disclose the fact that Kimberley Diamonds assumed it would obtain a 30% increase in the price of its rare fancy yellow diamonds.

Between March 2013 and May 2014, Kimberley Diamonds tried to negotiate an increase in the price of the yellow diamonds it sold to the luxury jewelry retailer Tiffany & Co. When those negotiations stalled in May, the companys shares fell by 41.5% and its revised earnings dropped from $7.5 million to $1.5 million.

Rio Tinto to Hold Israel Specials and Colored Rough Tender

Miner Rio Tinto will hold a “Specials and Colored Rough Tender” of large and fancy colored rough stones at the Israel Diamond Exchange from October 11 to 15. The tender system will be conducted by sealed-bid auction.

Rio Tinto stated that clients who are invited to participate will be offered large, high-value, single stones, parcels and natural colored rough diamonds in a wide range of sizes, shapes, qualities and colors, including pinks and fancy yellows.

More information, as well as registration, is available from Helene Wendelen at +32.3.303.6868 or via email at: helene.wendelen@riotinto.com.

RETAIL & WHOLESALE

Six Birmingham Jewelers to Supply $155M John Lewis Store

Six Birmingham jewelers will supply the city’s new John Lewis store, according to a statement on the Birmingham-based National Association of Jewellers’ website.

Designers James Newman, Kate Smith, Becca Williams, Rhiannon Lewis, Collette Waudby and Fei Liu will comprise the first group to supply more than 500 pieces of jewelry to the new store, which is valued at $155.2 million (GBP 100 million).

“This project has been over three years in the making and will allow John Lewis to access talented and upcoming designers from the Jewellery Quarter, providing a unique customer experience,” Jilly Cosgrove, board member of the Jewellery Quarter Development Trust, explained. “Each group of designers will rotate on a six-month basis, allowing us to demonstrate the breadth of talent here in the quarter.”

Kay Jewelers Debuts Star Wars Collection

Kay Jewelers introduced a new Star Wars collection as part of its Charmed Memories compilation, which features hand-crafted charms that allow guests to celebrate special moments, interests and passions.

Available at stores across the U.S. and online at Kay.com, the collection features some of the most popular Star Wars characters, including Darth Vader, R2-D2 and the storm troopers, as well as iconic quotes and themes from the films on charms that can be combined to create a unique bracelet or added to an existing piece.

Pease & Curren Offers Jewelry Recycling Scheme

Precious metals refiner and recycler Pease & Curren introduced a retail jewelry recycling and precious metals reclamation program for U.S. jewelry retailers and bench jewelers with multiple locations or larger facilities.

The company said its Corporate Retail Advantage will provide customers with customized reporting on the gold or precious metals processed, while a refining consultant will offer suggestions for waste reduction and ways to maximize the return on recycling and refining.

Malabar Gold to Invest $125M in New Outlets

Malabar Gold and Diamonds, one of the worlds largest gold and diamond retailers, announced that it will open 21 retail stores across the GCC, India and Far East in the next six months with an investment outlay of $125 million.

The company will open eight stores in the UAE, five outlets in Saudi Arabia, three in Oman and one in Malaysia, as well as four more stores in India, taking the chain to 155 stores. One 12,000-square-foot store in Abu Dhabi will constitute the largest jewelry retail outlet in the Middle East.

The move is part of the $700 million expansion announced by Malabar in 2013 that is expected to more than double the number of its outlets to 220 by the end of 2018.

Sothebys Kicks Off Fall Auction Season with Important Jewels Sale

Sotheby’s fall New York auction season opens with next week’s Important Jewels sale on September 24 and September 25. Public exhibition of the sale items begins September 19.

The jewelry auction will feature items of notable provenance from the collection of Dolores Sherwood Bosshard, including formal pieces by Harry Winston and Van Cleef & Arpels and daytime jewels by David Webb, Sterlé and Cartier.

Jewels owned by cosmetics heiress Estee Lauder and former U.S. first lady Mamie Doud Eisenhower are also slated to be sold.

Among the exceptional diamonds and gemstones on offer will be a pair of platinum, emerald and diamond pendant ear clips by Harry Winston with a pre-sale estimate of $650,000-$750,000, as well as a platinum and diamond ring set with a 10.19-carat, D color, cushion-cut, internally flawless, type IIA diamond with a pre-sale estimate of $1.3 million to $1.6 million.

The complete sale catalog is available online at www.sothebys.com.

Richemont China Watch Sales Point to Improvement

Luxury watch-maker Richemont yesterday reported 4 percent constant-currency group sales growth for the five months to August 2015. Sales in Europe rose 26 percent, Japan 48 percent and Americas just 2 percent. Asia-Pacific sales were 18 percent lower, with Hong Kong and Macau even weaker, the company said.

Compagnie Financiere Richemont SA owns a portfolio of independently managed brands, including: Cartier, Van Cleef & Arpels, A. Lange & Sohne, Baume & Mercier, Officine Panerai, Piaget, Vacheron Constantin, Lancel and Montblanc.

This may be the first indication of a recovery for the high-end luxury watch industry in respect to a turnaround in China, according to Bloomberg analyst Deborah Aitken. The company said mainland China sales resumed growth, with retail sales expanding at a strong double-digit rate, offsetting falling wholesale sales there. Swiss watch exports to China were 4 percent lower in January to July vs. a year earlier, and 21 percent lower in Hong Kong, according to Aitken’s September 16 research note.

Mainland China is the third-largest market for Swiss watch sales, accounting for 6 percent of total Swiss watch exports. Hong Kong still ranks first, though with a decreased weighting of 15 percent this year vs. 20 percent in 2014. August Swiss watch exports are due for release on September 22.

MINING

Paragon Reports Better-Than-Expected Mothae Results

Paragon Diamonds PLC reported on the results of two independent studies that have been conducted on the Mothae kimberlite project in Lesotho, which Paragon is in the process of acquiring.

The studies, to be used as components for the project’s pre-feasibility and pre-economic studies, were carried out by The MSA Group and the results "exceed managements initial expectations," the company said.

The findings indicate that there is potential to “significantly increase” the projects net present value from original estimates for average diamond values of up to $2,000 per carat. The project is believed to contain over 20.0 million tons of ore, suggesting a potential mine life of over 10 years.

ALROSA Expected to Cut Rough Prices by 10%

ALROSA will lower rough diamond prices at its September sale by 8% to 10%, Russian news agency Interfax reported, citing unnamed sources.

“Preliminarily, the drop is 10% in the framework of the market situation,” one of the sources was quoted as saying. Another said ALROSA would cut prices by 6% to 13%, stating that “On average, its around 8%, for our assortment of +9 to 8 grainers etween 0.65 and 2 carat. This is not far from the drop at the De Beers [auction] in August.”

According to the quoted sources, 50% deferrals will be allowed, a higher percentage than in August. Unlike De Beers, ALROSA did not lower prices in August.

Gem Diamonds Sells 357-ct. Letšeng Diamond

Gem Diamonds announced that it sold an exceptional 357-carat white diamond for $19.3 million. The diamond was recovered at the Letšeng mine in Lesotho and sold in Antwerp

“The Letšeng mine has produced two remarkable over-300-carat diamonds during the year to date,” said CEO Clifford Elphick. He said the sale in Antwerp achieved a top price “despite current market conditions, providing further evidence of the price resilience of Letšengs large top-quality diamonds.”

Since Gem Diamonds acquisition of Letšeng in 2006, the mine has produced four of the 20 largest white gem-quality diamonds to ever be recovered.

Dominion Diamond’s Sales Drop

Canada’s Dominion Diamond Corporation, the world’s third-largest producer of rough diamonds by value, reported a 24% slump in second-quarter sales amid subdued demand in Asia. Sales in the quarter that ended on July 31 dropped to $209.7 million from $277.3 million one year ago. Dominion reported a loss before income tax of $2.8 million, compared with a quarterly profit of $38.2 million a year ago.

The Canadian miner lowered prices during its latest sale in August in response to muted demand from Chinese retailers, largely for the middle-size range of polished diamonds, which has brought fiscal year-to-date average prices down by about 5%, in line with market prices.

The rough diamond market “failed to maintain any of the momentum evident at the end of Q1 fiscal 2016,” the company stated in its quarterly report. “Polished prices continued to stagnate as slow retail growth in China instigated a more cautious approach to purchasing by jewelers.”

Trans Hex Sees Subdued Trading

Trans Hex reported that it earned $17.5 million (ZAR 236.1 million) from May, June and September tender sales of production from its wholly owned South African operations. The sales included 20,570 carats at an average price of $896 per carat.

Production at those operations amounted to 20,839 carats for the five months that ended on August 31.

The company said challenging market conditions and low demand from China and India have “slowed trading considerably, in a market which is already feeling the pressure of a global downturn.” Trans Hex expects trading and rough diamond prices to “remain subdued for the remainder of 2015.”

Stornoway Trims Loss as Flagship Project on Track

Stornoway Diamond Corporation, an exploration and development company listed on the Toronto Stock Exchange, pared its quarterly loss from a year ago as construction at its Renard Diamond Project continued in line with planned schedule and budget.

Net loss for the three months that ended July 31 fell by $1.4 million (CAD $1.8 million) to $7.3 million, compared with a loss of $8.7 million in the previous year, the company said in a statement on September 14.

“Construction progress continues to track ahead of plan, principal engineering is nearing completion, and all major facilities are on track to be enclosed and heated prior to the onset of cold weather conditions,” Matt Manson, president and chief executive officer of Stornoway, said in the statement.

While engineering progress at the Renard site was pegged at 80 percent, slower than the planned 87 percent, the overall advancement of construction stood at 35 percent, which is above the 33 percent expected during the three months.

GENERAL

AGTA Announces Board of Directors Election Results

The American Gem Trade Association (AGTA) announced the results of its annual board of directors election.

Jeffrey Bilgore of Jeffrey Bilgore, LLC was elected president. Cynthia Renée (Marcusson) of Cynthia Renee Inc. and Avi Raz of A & Z Pearls Inc. were re-elected as directors to the board. Kusam Malhotra of K & K Intl. and Jeff Mason of Mason-Kay Inc. were newly elected.

The directors will take office in February 2016 and serve three-year terms.

GIA Unveils Japanese Website

The GIA debuted its Japanese-language website as part of the organization’s outreach efforts to that country’s consumers and lab clients.

Translations at the site include more than 1.8 million words in the Gem Encyclopedia, Analysis & Grading, Professional Education, Research & News and About GIA sections.

Auctioneer Bonhams Names International Jewelry Director

London auction house Bonhams has named Daniel Struyf to the newly created role of international jewelry director. He will be responsible for expanding the company’s market share and lead its 30-person jewelry.

Struyf previously worked with Christie’s in New York, Hong Kong and Geneva, Olympic Diamond Corporation in New York and Hong Kong, and Antwerp’s Backes & Strauss.

STATS

India

August $Mil. %Chg. YTD $Mil. %Chg.

Polished Exports $1,755 -8% $14,336 -6%

Polished Imports $241 -53% $2,466 -44%

Net Exports $1,514 8% $11,870 10%

Rough Imports $610 -22% $9,330 -23%

Rough Exports $88 -24% $829 -19%

Net Imports $522 -22% $8,501 -23%

Net Diamond Account $933 34% $3,369 N/A

ECONWATCH

Diamond Industry Stock Report

Industry retail stocks were generally positive this past week, with Charles & Colvard (+5.7%) leading gains. The notable decliner was Birks Group (-23.5%). Sarine Tech (+11.3%) led advances in the Far East. Mining shares were down as a group, led by Kennady Diamonds (15.9%) and Dominion Diamonds (-9.4%).

View the detailed industry stock report.

(10:30 GMT) Sept. 17 Sept. 3 Chng.

$1 = Euro 0.8829 0.8933 -0.010

$1 = Rupee 66.171 66.5304 -0.4

$1 = Israel Shekel 3.8707 3.8979 -0.03

$1 = Rand 13.3706 13.8406 -0.47

$1 = Canadian Dollar 1.3199 1.3217 0.00

Precious Metals

Gold $1,117.71 $1,107.90 $9.81

Platinum $964.40 $990.60 -$26.20

Silver $14.86 $14.76 $0.10

Stock Indexes Chng.

BSE 25,963.97 25,463.55 500.42 2.0%

Dow Jones 16,739.95 16,253.57 486.38 3.0%

FTSE 6,216.86 6,187.33 29.53 0.5%

Hang Seng 21,854.63 21,562.50 292.13 1.4%

S&P 500 1,995.31 1,942.04 53.27 2.7%

Yahoo! Jewelry 1,009.66 1,007.45 2.21 0.2%

Múdry sa teší objaveniu pravdy, hlupák falošnosti.

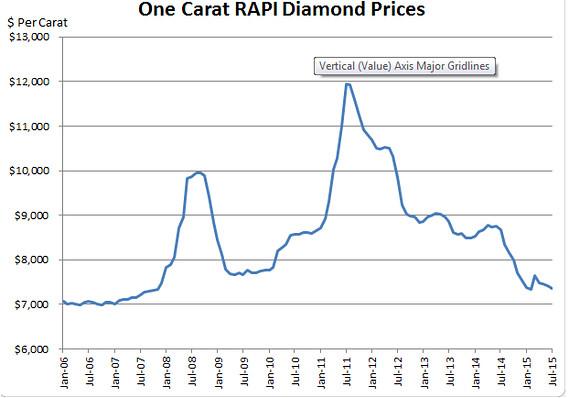

Grofik, neustále obdivujem tvoju japonskú vytrvalosť so zverejňovaním RapNet reportu. To si platíš alebo stačí len registrácia? Inak myslím si, že pre väčšinu ľudí by stačil veľmi jednoduchý graf ako tento: Priemerná cena jedno karátového diamantu podľa RAPI (RapNet Diamond Index):

Obrázky:

Z neho je jasné, že ani diamanty nie sú večné, teda večne obľúbené. Ich cena sa za posledné štyri roky prepadla o 40% a je rovnaká ako pred desiatimi rokmi. Keď k tomu pripočítam štandartnú výšku provízie dealerov 30% (pri nákupe aj predaji), tak "investor" z kapitálu vloženého do diamantov vygeneroval čistú stratu -67% .😎

Processed coin catalogs 4.152 Auctions / 35.000 Lots

Všetko o bankovkách www.mojazbierka.sk :)

Sent from my ZX Spectrum

Tak mi to skús vysvetliť. Mne ten graf pripomína bublinu "Dot.com" 1997-2000

Processed coin catalogs 4.152 Auctions / 35.000 Lots

Všetko o bankovkách www.mojazbierka.sk :)

Sent from my ZX Spectrum

Grofik, ty čaruješ ako smerácky minister financií😃

RapNet Data: September 17

Diamonds 1,321,787

Value $8,688,037,141

Carats 1,405,830

Average price $6.180/carat

The RapNet Diamond Index (RAPI) has been revised to reflect the average price of the 10 best priced diamonds in each category.

Od začiatku hovorím o priemernej cene jednokarátového diamantu a ty vytiahneš D IF a D Flawless. Takže žiadna zlá interpretácia grafu. Skôr tvoja dezinterpretácia. 😉 Alebo sa diamanty predávajú len v kvalite D IF ?

Processed coin catalogs 4.152 Auctions / 35.000 Lots

Všetko o bankovkách www.mojazbierka.sk :)

Sent from my ZX Spectrum

Nečarujem ,ale diamanty sa predávajú podľa kvalitatívneho zatriedenia nie podľa priemeru ceny za jeden karát.

Celkove je 124 zatriedený .😉

Rapaport sú veľkoobchodné nie maloobchodné ceny.

Mercedes, Volvo atď..., je iná výrobná cena iná predaj ... to len na okraj problému pre lepšie pochopenie.😉

Múdry sa teší objaveniu pravdy, hlupák falošnosti.

Grofik, ten graf slúži na pochopenie globálneho cenového trendu pri obchodovaní na trhu s diamantami. Ten vystihuje veľmi presne. To, že sa nevzťahuje na Koh-I-Noor, či diamant Nádej je asi všetkým jasné. Samozrejme chápem, že pre predajcov diamantov je veľmi nepríjemný ba priam nevysvetliteľný.🙂

Pravdepodobne budeš so mnou súhlasiť, že nikoho nezaujíma "maloobchodná" cena zlata v záložni v Petržalke, ale všetci sledujú "veľkoobchodnú" cenu na burze. To len na okraj problému pre lepšie pochopenie😉

Processed coin catalogs 4.152 Auctions / 35.000 Lots

Všetko o bankovkách www.mojazbierka.sk :)

Sent from my ZX Spectrum

Fidzi cena zlata ,platiny a iných drahých kovov sa určuje poväčšine pri čistote 99,95 - 99,99 ostatné čistoty existujú napr.99,999 až 99,999999 ,ale sú extrémne drahé .

Od čistoty 99,95 sa odvíja cena nadol podľa rýdzosti ,

pri diamantoch súhlasím je priemerná cena zahrňujúca od farby D po Z a čistoty IF po SI3 štatisticky je od 2-3,5% top kvalita atď... preto pokiaľ poznáš systém je ľahšie predať 5 ct. brúsený diamant najvyššej kvality ako 5 ct. priemernej a nižšej kvality .

Ale to investori klopú iným ľuďom na dvere určite nie mne.😃

Diamanty čo si uviedol sa riadia úplne inou cenou ako bežný rapaport ,ale to nie len diamanty , rubíny, smaragdy, alexandrity atď , atď....

Múdry sa teší objaveniu pravdy, hlupák falošnosti.

Pro vkládání příspěvků se musíte přihlásit.