Rapaport Weekly Market Comment March 29, 2013

Markets quiet due to holidays. Harry Winston completes $1B retail division sale to Swatch, changes name to Dominion Diamond Corp. ALROSA 2012 production flat at 34M cts., increases reserves by 36M cts. to approx. 683M cts. Signet 4Q sales +12% to $1.5B, same-store +4%, profit +10% to $172M. Tiffany 4Q sales +4% to $1.2B, same-store flat, profit +1% to $180M. THE RAPAPORT PRICE LIST WILL NOT BE PUBLISHED MAR. 29 DUE TO PASSOVER HOLIDAY.

RapNet Data: Mar. 28

Diamonds 945,181

Value $6,160,297,989

Carats 1,038,994

Average Discount -27.32%

www.rapnet.com

Get Current Price List | Subscribe to Rapaport | Join RapNet

RAPAPORT ANNOUNCEMENTS

April

9-17

Tue-Wed

Rapaport Melee Auction

New York & Dubai

View details.

April

16-24

Tue-Wed

Rapaport Single Stone Auction

New York & Israel

View details.

QUOTE OF THE WEEK

While we believe rough diamond prices are likely to see a steady upward trend from this year onwards, and the signs in first quarter have been very encouraging, diamond prices remain volatile and can be rapidly influenced by any negative shift in perceptions as to the economic outlook; particularly in the U.S., which makes up more than 40% of the market. Rough prices are also heavily exposed to any tightening of credit, which impacts the ability of cutters and polishers to fund inventory.

Panmure Gordon & Co. |

Careers@Rapaport

The Rapaport Group is growing rapidly. If you wish to work with the best and brightest, join us. We have great opportunities for trading managers, gemologists, sales assistants, and entry level positions for our offices in New York, Antwerp, Mumbai, Dubai, and Shanghai. View jobs now.

INDUSTRY

Harry Winston Completes Sale to Swatch

Dominion Diamond Corporation, formerly Harry Winston Diamond Corporation, completed the sale of its luxury division, Harry Winston Inc., to the Swatch Group. As part of the $1 billion agreement, the mining company changed its name to Dominion Diamond. In connection with the name change, the companys stock symbol will change from HW to DDC on the Toronto Stock Exchange and from HWD to DDC on the New York Stock Exchange. Dominion Diamond remains focused on mining and marketing rough diamonds with a 40% stake of the Diavik diamond mine in Canadas Northwest Territories and rough diamond sorting and sales operations in Canada, Belgium and India. Dominion Diamond is awaiting regulatory clearance on the purchase of an 80% stake in the Ekati diamond mine, located in the Northwest Territories, as well as a controlling interest in surrounding areas containing significant prospective resources from BHP Billiton.

ALROSA Increases Reserves, Production Flat

ALROSA’s production was basically flat at 34.2 million carats in 2012, however, its reserves grew approximately 35.8 million carats due to the exploration of Ebelyakh and Gusiny placers, according to the mining giants executive committee. Prior to the increase in reserves, ALROSAs first mineral audit up to January 1, 2012, which covered about 70% of its Russian resource base, excluding the Catoca venture in Angola, revealed indicated reserves of 646.5 million carats and another 311.6 million carats inferred, based upon JORC standards.

The groups executive committee is also considering reforming ALROSA’s cutting and polishing operations, including its production facilities in Moscow, Brillianty ALROSA, and those in Barnaul and Oryol. Polishing facilities for small and medium-size rough diamonds would move from Moscow to Oryol and Barnaul. In addition, the company would enhance its technology and training at Oryol and the Barnaul Kristall Factory. The Brillianty ALROSA Branch would concentrate on manufacturing high-quality and fancy colored polished diamonds, the board noted.

RETAIL & WHOLESALE

Signets 4Q Profit +10%

Signet Groups fourth-quarter sales rose 12% year on year to $1.5 billion for the 14 weeks that ended on February 2, 2013 compared with a 13-week period that ended on January 28, 2012. Same-store sales grew only 4%, while Internet sales rose 45% to $64 million. The jewelry retail chain reported a 10% increase in its cost of sales to $876.2 million, while gross margin improved 50 basis points to 42.1%. Profit rose nearly 10% to $171.8 million.

Signet’s sales rose 6.2% year on year for the fiscal period that represented 53 weeks, ending on February 2, to $3.98 billion, while same-store sales rose 3.3%. U.S. division sales jumped 7.9% to $3.27 billion, comparable-store sales rose 4% and branded differentiated and exclusive products increased its participation by 110 basis points to 27.4% of merchandise sales. Sales in other categories were primarily driven by colored diamonds and strong growth in watches, excluding the impact of the discontinuation of Rolex.

Tiffanys 4Q Profit +1%

Tiffany & Co. reported that sales increased 4% year on year to $1.24 billion for the fourth quarter that ended on January 31 and same-store sales were flat. Internet and catalog sales rose 6%. Cost of sales rose more than 7% to $505 million, pressuring gross margin to 59.1% from 60.4% one year earlier. Earnings improved just slightly, by 0.7% year on year, to $179.6 million or $1.40 per diluted share. Regional sales were strongest in the Asia-Pacific and weakest in the Americas.

Fiscal year sales also rose 4% year on year to $3.79 billion, while cost of sales jumped better than 9% and earnings fell 5% to $416.2 million or $3.25 per diluted share. The weakest region was the Americas where same-store sales fell 2%, but comparable-store sales powered ahead 8% in the Asia-Pacific region. Gross margin fell to 57% from 59% and largely reflected pressure from higher precious metals and diamond costs. The companys debt was $959 million compared with $712 million one year earlier and inventory levels rose 8% to $2.2 billion.

Historic Ring Sells for $1M

The Osenat auction house in Fontainebleau, France sold the engagement ring Napoleon Bonaparte gave Josephine de Beauharnais for approximately $1.2 million, including buyers premium, against a presale estimate of $13,000 to $20,000. The gold ring garnered fierce and active bidding during the sale and features a pear-shaped sapphire and a diamond, set in the form of a toi et moi, which reportedly weigh just under a carat each. The auction house defined the ring as part of a collection from the Emperor Napoleon III and Empress Eugenie. Bonaparte gave the ring to de Beauharnais on February 24, 1796 from the collection of gems of the Imperial House. The couple married March 9, shortly before Bonaparte departed to carry out plans to invade Italy. Osenat held the sale on March 24 to mark de Beauharnais 250 birthday.

LJ to Go Private for $2 Per Share

LJ International Inc. entered into an agreement to merge with Flora Bloom Holdings and Flora Fragrance Holdings Limited for $2 per ordinary share. LJ International stated that the transaction price represents a 24.2% premium based upon its closing share price of August 10, 2012, the last trading day prior to receiving a "going private" proposal. Immediately following the transaction, Flora will be owned by a consortium of investors led by LJs top principals, Urban Prosperity Holding Limited, an entity owned by FountainVest China Growth Capital Fund.

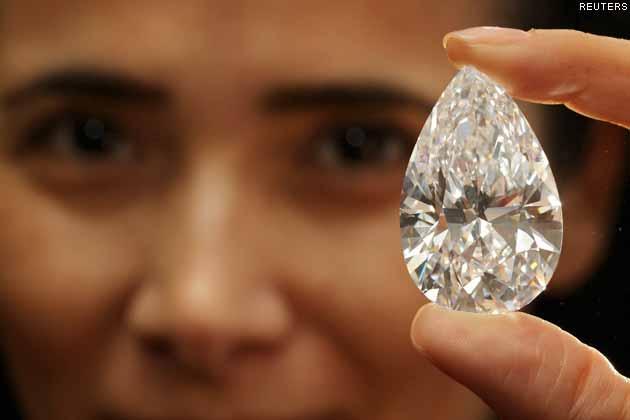

Sothebys to Sell 75-Ct. Pear-Shape Diamond

Sotheby’s New York annual spring auction of Magnificent Jewels on April 17 will offer 400 lots and a combined presale estimate in excess of $35 million. The centerpiece of this sale is an exceptional 74.79-carat, D, VVS1, potentially flawless, type IIa, pear-shaped diamond with a presale estimate of $9 million to $12 million. Lisa Hubbard, the chairman of North & South America at Sotheby’s International jewelry division, said the diamond was a truly exceptional stone that was acquired by the present owner in 2001 for $4.3 million. Additionally, jewels from the estates of Lynn Wolfson and the Gould family will highlight the auction.

JCP Resumes Promotional Pricing

Reversing its decision to offer everyday low prices in 2012, J.C. Penney resumed raising product prices at its stores with the intention of offering more typical discounts and or sales promotions in an effort to win back consumers. JCPenney lost market share and about one quarter of its revenue since changing its pricing strategy more than one year ago. The retailer stated that it now understands shoppers are motivated by promotions and prefer to receive discounts. The companys CEO, Ron Johnson, has acknowledged that it was a mistake to change a pricing policy overnight.

Integrate for Mobile or be Forgotten

Surviving the luxury marketplace requires a robust, engaging, sticky and fully integrated website and active social media presence on a mobile platform, according to the latest research from Unity Marketing. High-end consumers, or those with an income average of about $250,000, are increasingly using mobile devices as a means to engage retailers online with 98% of those surveyed shopping the Internet this way in the past three months. Those who made a purchase spent $3,702 on average and five hours per week conducting shopping-related activities.

Unity Marketing found that the number of shoppers who made purchases using a mobile device doubled to 40% overall from the previous year. A majority of young affluents report having used a mobile device more often to purchase products than mature affluents, or those 45 to 70 years of age, the group found. Affluent shoppers are not about to back step in their habits, Unity concluded, and jewelry industry marketers must be on the same page or be forgotten all together by the most important U.S. consumer group.

GENERAL

De Beers Jewellers Appoints Wang

De Beers Diamond Jewellers hired Jeanne Wang as its managing director for China. Wang spent the past 16 years with Chanel and most recently served as general manager of the Chanel fashion division in China. Wang was instrumental in building Chanel in China, including the fashion, watch and fine jewelry businesses. Prior to joining Chanel, she acquired retail operation experience as the brand manager for Max Mara.

HRD Appoints Couvreur

HRD Antwerp appointed Serge Couvreur as its general manager to succeed Georges Brys. Couvreur will focus on communicating HRDs unique competencies. Couvreur studied at Haute Etudes Commerciales and holds a degree in Commercial Management & Marketing. During his six years in office, Brys developed HRD Antwerp as a leader in technology and reinforced its international presence by opening a diamond-grading laboratory in Mumbai, a jewelry laboratory in Turkey and several drop-off services worldwide. He successfully launched programs with Chinese partners and reached key agreements in the field of research, diamond technology, training and equipment.

GJEPC, IDI Project to Boost Productivity

The Gems & Jewellery Export Promotion Council (GJEPC) and the Indian Diamond Institute (IDI) began a detailed project report to establish 13 fully-equipped diamond cutting and polishing centers in Gujarat, as part of the 12th Five Year Plan, in an effort to better serve small diamond manufacturers that have limited resources to invest in state-of-the-art equipment. The common facilities are expected to replace outdated technology and increase productivity of smaller firms.

Mouawad Necklace Achieves World Record

Mouawad is showcasing its LIncomparable Diamond necklace until April 6 at its boutique in the Dubai Mall. The Guinness World Records in London told Rapaport News that this piece was recorded as the Most Valuable Necklace in the world on January 9 and priced at $55 million or GBP 36,361,323. The necklace features a total carat weight of 637, and includes a 407.48-carat modified, shield step-cut, IF natural fancy deep yellow diamond, 35 round diamonds, 27 pear-shaped diamonds, nine heart-shaped diamonds, five emerald-cut diamonds, five cushion-shaped diamonds, four oval diamonds, three Asscher-cut diamonds and two radiant diamonds. The necklace made its debut at the Doha Jewellery & Watch Exhibition in February.

Aire Wins Trademark Validation

The U.S. Ninth Circuit Court reversed a lower court’s dismissal of a trademark lawsuit where Breitling USA Inc. was accused of infringing on Chris Aires Red Gold® trademark. The case, filed by Solid 21 Inc. on behalf of Chris Aire Fine Jewelry and Timepieces, is one of 15 suits Aire filed in January 2011 to protect the companys Red Gold trademark. In the lawsuits, Aire accused Breitling, Swatch, Bulgari, LVMH Moet Hennessy Louis Vuitton and several other watch brands of using the Red Gold mark despite the fact that his company has held a trademark registration certificate for Red Gold since 2003.

The U.S. Patent & Trademark Office (USPTO) also deemed the trademark incontestable as far back as 2007, according to Aires legal team. Since obtaining his trademark, Aire stated he has spent millions of dollars to brand the trademark and create demand for the line in the marketplace via tastemakers and other celebrities.

EU Further Relaxes Sanctions on Zimbabwe

Following what it called a successful constitutional referendum in Zimbabwe, the European Union (EU) further relaxed sanctions on the African nation. The EU began honoring a commitment to ease restrictions on people and entities in Zimbabwe in February following each new democratic reform measure. In a declaration posted by the High Representative, Catherine Ashton, on behalf of the EU, restrictions were suspended against 81 individuals and eight entities. However, 10 people, including President Robert Mugabe, and two companies, including the Zimbabwe Mining Development Corporation (ZMDC), remained under EU sanctions, pending a free and fair presidential election, which is tentatively scheduled for July.

MINING

Lucara Narrows Loss as Sales Begin

Lucara Diamond reported revenue of $29.1 million for the fourth quarter that ended on December 31, and sales of $41.8 million for the fiscal year. The junior mining company reported no revenue in the previous year. Lucara narrowed its loss for the year to $7.5 million compared with a loss of $18.7 million in 2011. During the year, the companys Karowe diamond mine in Botswana treated 1.4 million tonnes of ore, or 9% above the forecast, and produced 303,000 carats, which was 12% above guidance. At the Mothae project in Lesotho, a trial mining program was completed in September with final processing of hard, unweathered kimberlite from the central resource domain of the south lobe of the Mothae kimberlite.

Lucara held five sales in 2012 that included 215,762 carats of rough diamonds. Proceeds totaled $54.6 million at an average price of $253 per carat. Included in these results is the sale of a 9.46 carat blue diamond for $4.5 million or $477,272 per carat. But the company excluded from its total revenue Karowes June, July and a portion of the September sales totaling 63,038 carats for proceeds of $12.8 million and related operating expenses and royalty expenses.

Botswana Diamonds Loss Grows

Botswana Diamonds reported a loss of about $430,000 for the six months that ended on December 31, up 23% year-on-year, and no revenue for the period. However, the junior explorer nearly doubled the amount of cash and cash equivalents to $490,000 and total assets rose 9% year on year to $10 million. The company has exploration programs underway in Botswana, Cameroon and Mozambique. Botswana Diamonds is operating a joint venture to identify new diamondiferous kimberlites in Botswana in the Orapa region and it holds an option on 13 blocks in the Gope region.

True North to Raise $16M

True North Gems Inc. will conduct a brokered private placement of up to 175 million Class A common shares priced at 9 cents each, resulting in aggregate proceeds of up to $15,750,000. The subscriber under this private placement will be Lenomi Holdings Limited, a private investment company controlled by Joseph Gutnick. The transaction will occur in three phases (tranches) between early April and July, with the final phase requiring shareholder approval. True North intends to use the proceeds to advance its Aappaluttoq Ruby Project in Greenland.

Firestone Narrows Loss to $8M

Firestone Diamonds revenue rose to $7.8 million for the six months that ended on December 31, compared with $3 million one year earlier. The junior miners cost of sales fell 17% to $7 million and this enabled it to narrow its loss 43% to $7.5 million. During the first half of the fiscal year at the Liqhobong diamond mine in Lesotho, the number of carats sold jumped 85% to 79,071 and prices achieved $102 per carat, up from $59 per carat in the previous year. Firestone produced 72,833 carats during the period, compared with 69,319 carats one year earlier. The BK11 diamond mine in Botswana remained on care and maintenance during the period.

ECONWATCH

Diamond Industry Stock Report

U.S. stocks were mixed, Signet jumped 8%, both Birks and Zale fell 8%; in Hong Kong, Chow Sang Sang surged 7%, while in India, C.Mahendra leaped 10% and Su-Raj fell 9%. Mining shares were lower except Lucara (+8%) and True North (+33%). View the extended stock report

Mar. 28 Mar. 21 Chng.

$1 = Euro 0.780 0.775 0.005

$1 = Rupee 54.29 54.29 0.0

$1 = Israel Shekel 3.64 3.67 -0.03

$1 = Rand 9.20 9.31 -0.11

$1 = Canadian Dollar 1.02 1.02 0.00

Precious Metals

Gold $1,596.30 $1,615.00 -$18.70

Platinum $1,571.00 $1,578.00 -$7.00

Stock Indexes Chng.

BSE 18,835.77 18,792.87 42.90 0.2%

Dow Jones 14,574.85 14,421.49 153.36 1.1%

FTSE 6,411.74 6,388.55 23.19 0.4%

Hang Seng 22,299.63 22,225.88 73.75 0.3%

S&P 500 1,568.94 1,545.80 23.14 1.5%

Yahoo! Jewelry 1,189.95 1,148.71 41.24 3.6%

Múdry sa teší objaveniu pravdy, hlupák falošnosti.

Rapaport Weekly Market Comment April 5, 2013

De Beers raises prices 3% to 8% with April sight estimated at $650M. Secondary market speculation continues with boxes trading at premiums. CAUTION: "Rough prices are not sustainable at current level of polished prices. Rough dealers and banks are supporting risky speculative rough buying." Diamond trading quiet after Passover and Easter holidays but polished prices firm. RapNet Diamond Index (RAPI) for 1ct. stable in March, +0.4% in 1Q. Dominion Diamond Corp. 4Q sales +8% to $110M, net profit -10% to $15M, closes Ekati purchase. Chow Sang Sang 2012 revenue +6% to $2.4B, net profit -10% to $127M. Israel’s 1Q polished exports -8% to $1.6B, rough imports -10% to $891M.

RapNet Data: Apr. 4

Diamonds 936,756

Value $6,135,871,459

Carats 1,039,690

Average Discount -27.54%

www.rapnet.com

Get Current Price List | Subscribe to Rapaport | Join RapNet

RAPAPORT ANNOUNCEMENTS

April

9-17

Tue-Wed

Rapaport Melee Auction

New York & Dubai

View details.

April

16-24

Tue-Wed

Rapaport Single Stone Auction

New York & Israel

View details.

QUOTE OF THE WEEK

Rough prices are not sustainable at the current level of polished demand. Responsible diamond manufacturers, rough dealers and their banks should refrain from supporting risky speculative rough buying.

Martin Rapaport | Rapaport Group

Careers@Rapaport

The Rapaport Group is growing rapidly. If you wish to work with the best and brightest, join us. We have great opportunities for trading managers, gemologists, sales assistants, and entry level positions for our offices in New York, Antwerp, Mumbai, Dubai, and Shanghai. View jobs now.

INDUSTRY

Polished Prices Steady in March

Certified polished diamond prices held steady in March with 0.30 carat stones continuing to outpace other sizes. Market sentiment improved in the first quarter, driven by seasonal Far East demand during the Chinese New Year period and steady U.S. bridal demand. The RapNet Diamond Index (RAPI™) for 1ct. certified polished diamonds increased by 0.1% in March, RAPI for 0.3ct. diamonds rose 1.9%, while 0.5ct. stones declined 0.1% and 3ct. diamonds increased 0.2%. During the first quarter, RAPI for 1ct. diamonds rose 0.4% but it remains 11.1% below levels reached one year ago.

Speculative rough demand influenced an estimated 4% increase in rough prices in the secondary market in March, with premiums reaching around 5%. Diamond manufacturers are encouraged by the recent stability in the polished market and have enjoyed slightly better profit margins so far this year, however, they remain cautious as rough prices are persistently one step ahead of the polished, narrowing their margins and further tightening cutting-center liquidity.

Purchase the Rapaport Monthly Report, “Cutting Margins” for all the details.

RETAIL & WHOLESALE

Chow Sang Sangs Profit -10%

Chow Sang Sang Holdings International reported that its revenue from the jewelry division surged 18% year on year to $1.9 billion in 2012. Revenue from the groups other businesses, which included wholesaling of precious metals, fell 25% to $438 million but combined company turnover rose 6% to $2.4 billion. Same-store growth was 9%.

Profit attributed to equity holders fell 10% to $127 million. By geographic region, the companys sales were basically flat in Hong Kong an in Macau at $1.6 billion but revenue rose 24% from Mainland China to $720 million. Chow Sang Sang reported no growth in the sale of higher-priced items and in an effort to lure customers into shop, department stores and the competition resorted to discounting, adding further downward pressure to the companys own gross margin.

Kingolds Profit Soars

Kingold Jewelry reported fourth quarter sales rose 20% year on year to $201.4 million for the period that ended on December 31. Cost of sales increased 17% to $189.7 million. Profit surged 133% to $7.4 million or 14 cents per share. Fiscal year sales improved 16% to $915.7 million and profit rose 25% to $32.7 million or 60 cents per diluted share. The gold jewelry manufacturing firm processed 37.8 metric tons of 24-karat gold products during the year, representing an increase of 26% from 2011, and expanded its business reach into new geographic regions across China. Additionally, by the end of 2012, Kingold had signed agreements with four major Chinese banks and widen the geographic reach of its investment gold business to make products available at 366 retail bank branches across eight provinces in China.

Sterling, Zale to Select Mediators

The U.S. District Court for the Northern District of Ohio referred Sterling Jewelers Inc. and Zale Corporation into mediation, or alternative dispute resolution (ADR), in a diamond advertising lawsuit. Sterling sued Zale in November alleging that Zales advertisements for the Celebration Fire diamond as "the most brilliant diamond in the world" were false and misleading. In accordance with Judge John Adams referral notice, both parties have until April 10 to review, confer and appoint three court approved mediators.

JCPenney Adds Bijoux Bar Jewelry Concept

WATCH NOW: While trading slowed in the U.S. and Israel during the Passover holiday, demand in India remained selective with the best activity in the 0.30ct. to 0.69ct. range. Kristall held its fourth polished tender, which achieved $2 million from 51 lots sold. J.C. Penney is adding lower price point designer jewelry to its offerings, all pieces under $400, with a new Bijoux Bar display counter that features 16 designers. Bijoux Bar previews online April 18 and then appears in 650 JCPenney store locations on April 28.

Birks Markets Conflict-Free Fancy Yellow Diamond

Birks in Canada is premiering a 16.01 carat, VVS1, fancy intense yellow diamond at its Edmonton location beginning this week. The diamond is set in a platinum ring and adorned with diamond pavé. The diamond will head to Birks in Calgary after its Edmonton showing. This yellow diamonds color is of natural origin and its large size and high-clarity makes it exceptional, according to Birks. The stone was recently discovered and the retailer is marketing it as guaranteed conflict-free since it was sourced ethically through a responsible chain of custody.

Lollobrigidas Jewels Highlight Sale

Sothebys will offer 23 jewels from the collection of actress, photojournalist and sculptor, Gina Lollobrigida, at its upcoming Magnificent Jewels and Noble Jewels Sale in Geneva on May 14. The collection will feature important Bulgari jewels from the 1950s and 1960s worn by Lollobrigida at landmark moments in her career. The jewels were also highlights of the international touring exhibition, Bulgari – 125 Years of Italian Magnificence in 2009 to 2012. Lots include a pair of natural pearl and diamond pendant earrings, a 1954 diamond necklace-bracelet combination and a pair of detachable pear-shaped emerald and diamond earclips

IDD Partners With Aghjayan

IDD of New York partnered with bridal designer Harout Aghjayan to create the “HAROUTR” Bridal Collection for independent retailers. Harout’s designs are often associated with innovative artistry, fine workmanship and attention to detail. Harout developed this line to utilize an interchangeable head concept, allowing for designer styling with the flexibility of customization.

GENERAL

De Beers, Rio Tinto Update Client Lists

De Beers and Rio Tinto updated their client lists for the current year with De Beers adding five sightholders (82 in total) for the contract year that began on April 1 and Rio Tinto increasing the number of select diamantaires to 17 from 13.

De Beers Sightholder List 2012-2015

- A. Dalumi Diamonds (Israel)

- Almod Diamonds (USA)

- AMC NV (Belgium)

- Ankit Gems (India)

- Arjav Diamonds (Belgium)

- Asian Star (India)

- Bhavani Gems (India)

- Blue Star Diamonds (India)

- Chow Sang Sang (Hong Kong)

- Chow Tai Fook (Hong Kong)

- Crossworks Manufacturing (Canada)

- Dali Diamond (Belgium)

- DDM Arabov Group (Israel)

- De Toledo Diamonds (Israel)

- Dharmanandan Diamonds (India)

- Diacor International (Switzerland)

- Diamanthandel A Spira (Belgium)

- Dianco (Belgium)

- Diarough (Belgium)

- Digico Holdings (Hong Kong)

- Dilipkumar V. Lakhi (India)

- Dimexon International(India)

- E.F.D. (Israel)

- Eloquence Corporation (USA)

- Eurostar Diamonds (Belgium)

- Exelco (Belgium)

- EZ Diamonds (Israel)

- Fruchter Gad Diamonds (Israel)

- Gitanjali Gems (India)

- Gold Star Diamond (India)

- Hard Stone Processing (Namibia)

- Hari Krishna Exports (India)

- Hasenfeld-Stein (New York)

- H Dipak (India)

- Henri Polak (USA)

- Hvk International (India)

- IGC Group (Belgium)

- Jasani (India)

- Jewelex India (India)

- Julius Klein Diamonds (USA)

- K Girdharlal International (India)

- KARP Impex (India)

- KGK Diamonds (India)

- Kiran Gems (India)

- KP Sanghvi & Sons (India)

- Kristall (Russian Federation)

- L. M. Van Moppes & Sons (United Kingdom)

- Laurelton Diamonds (Belgium)

- Laxmi Diamond (India)

- Lazare Kaplan International (USA)

- Leo Schachter International (Israel)

- Lieber & Solow (USA)

- M Suresh Company (India)

- Mahendra Brothers Exports (India)

- Mohit Diamonds (India)

- MOTIGANZ Diamond Group (Israel)

- Niru Diamonds Israel (1987) (Israel)

- Pluczenik Diamond Company (Belgium)

- Premier Gem (Group) (USA)

- Richold (Switzerland)

- Rosy Blue (India) (Belgium)

- Rosy Blue Business Alliance (Belgium)

- S. Vinodkumar Diamonds (India)

- Safdico (Mauritius)

- Sahar Atid Diamonds (Israel)

- Schachter and Namdar (South Africa)

- Shairu Gems (India)

- Sheetal Manufacturing Company (India)

- Shree Ramkrishna Export (India)

- Shrenuj & Company (India)

- Star Diamond Group (Belgium)

- Stuller (USA)

- Suashish Diamonds (India)

- Tache Company (Belgium)

- Tasaki & Co. (Japan)

- Trau Bros (Belgium)

- Venus Jewel (India)

- Vijay Diamond (UAE)

- Wing Hang Company (Hong Kong)

- Yerushalmi Bros. Diamonds (Israel)

- Yoshfe Diamonds International (Israel)

- Yosi Glick Diamonds (2003) (Israel)

Rio Tinto Select Diamantaires of 2013

- Crossworks Manufacturing (Vancouver)

- CTF Diamond Trading Company (Hong Kong)

- Diambel (Antwerp)

- Dianco (Antwerp)

- Diarough (Antwerp)

- Dimexon Diamonds (Mumbai)

- E. Schreiber (New York)

- Gemmata (Antwerp)

- Hari Krishna Exports (Mumbai)

- IDH Diamonds (Antwerp)

- Interjewel (Mumbai)

- KP Sanghvi & Sons (Mumbai)

- L&N Diamonds (Ramat Gan)

- Laurelton Diamonds (Antwerp)

- Sheetal Group Mumbai (Antwerp)

- Signet Direct Diamond Sourcing (U.S.)

- Venus Jewel (Mumbai)

Istanbul Show Attendance +30%

UBM Rotaforte, through the sponsorship of Turk Ekonomi Bankasi (Turkish Economy Bank), concluded its 36th Istanbul Jewelry Show in March, attaining record attendance at nearly 27,000, up 30% from one year ago. UBM determined that eight in 10 show attendees were domestic, while 19% arrived from overseas, representing 110 countries. UBM also hosts an Istanbul jewelry fair in September or October.

GJEPC Hosts Banking Conference

The Gem & Jewellery Export Promotion Council (GJEPC) hosted a banking conference aimed at strengthening the diamond industry’s relationship with lending institutions. Indian bank credit to the diamond industry is estimated to be about $6 billion with an average utilization rate of around $5.3 billion. With Basel 3 regulations being implemented this year, the global banking sector is exercising greater scrutiny in lending.

MINING

Dominions Profit -10%

Dominion Diamond Corporation, formerly known as Harry Winston Diamond Corporation, reported that sales from its mining operations rose 8% year on year to $110.1 million in the fourth quarter that ended on January 31. Profit dropped 10% to $14.8 million, or 18 cents per share, as operating profit from the mining division fell 5% to $12 million and retail profit declined 28% to $2.8 million. Rough diamond sales improved due to an 11% increase in prices and an improved sales mix, even though this was partially offset by a 3% decrease in the volume of goods sold from the Diavik mine.

The company reported that it held 500,000 carats of rough diamonds in inventory, estimated at $65 million as of January 31, of which approximately $25 million worth of goods were available for sale and the remaining $40 million are currently being sorted. For the full fiscal year, sales from continuing mining operations rose 19% to $345.4 million and retail sales rose 6% to $435.8 million. The increase resulted from a 49% rise in the volume of carats sold during the year, offset by a 20% decrease in achieved rough diamond prices. Profit rose 38% to $35.2 million as the mining division contributed $22.8 million, up 32% year on year, and retail contributed $12.4 million, up 58 percent.

Dominion expects to close its acquisition of the Ekati mine in the coming week after receiving regulatory approval from the government of Canada and authorities in the Northwest Territories. The company agreed in November 2012 to buy the mine from BHP Billiton for $500 million. The deal includes Ekati’s associated diamond-sorting and sales facilities in Yellowknife and Antwerp.

Kennady Intersects Kimberlite

Kennady Diamonds Inc. intercepted kimberlite at its first two drill holes on the Kennady North diamond property. Drill hole KDI-13-001 was drilled approximately 100 meters to the northwest of the main Kelvin kimberlite and intersected kimberlite over approximately 33 meters from a down-hole depth of approximately 62 meters in addition to intermittent intersections from approximately 207 meters to 215 meters. A second hole, KDI-13-002, was drilled from the same platform, but at a shallower inclination. This hole intercepted kimberlite at a down-hole depth of approximately 60 meters. Drilling of this hole continues.

Goodrichs Tender Nets $13M

Goodrich Resources Ltd. held its first rough diamond sale following the acquisition of the Kimberley Diamond Company in January. Goodrich reported selling 13,234.88 carats for $12.7 million during a March tender. The company also reported on its recovery grade, which was 4.42 carats per hundred tonnes (CPHT) of ore, representing an 18 percent improvement against the 2012 average of 3.74 carats CPHT. Goodrich expects to release its financial results at the end of April.

ALROSA, ENDIAMA Target New Projects

ALROSA and Angola’s ENDIAMA are discussing prospects for exploration using geological material already produced by ALROSA’s specialists in Angola that indicate a high probability of discovering a new large primary diamond deposit. In other news, ALROSA sold its controlling stake in the iron ore project OJSC Timir to EVRAZ for $160 million, providing EVRAZ with a 51% stake to ALROSAs 49% share and Vnesheconombank holds one share.

Shore Gold Narrows Loss

Shore Gold Inc. recorded a loss of $9.3 million or 4 cents per share for the fiscal year that ended on December 31, compared with a loss of $219.9 million or 98 cents per share in 2011. The diamond explorer is proceeding with the completion of its environmental permitting process for the Star-Orion South diamond project in Canada and continues to seek capital through a third party or a syndicate of investors. Shore Gold reported working capital of $8.6 million as of December 31.

ECONWATCH

Diamond Industry Stock Report

U.S. stocks mostly higher except for Blue Nile (-3%), Movado (-6%) and Signet (-2%). Mining shares were lower led by Stellar (-14%), Gemfields (-13%), True North (-13%), Lucara (-9%) and Rocwell (-4%). View the extended stock report

Apr. 4 Mar. 28 Chng.

$1 = Euro 0.770 0.780 -0.010

$1 = Rupee 54.89 54.29 0.6

$1 = Israel Shekel 3.62 3.64 -0.02

$1 = Rand 9.15 9.20 -0.05

$1 = Canadian Dollar 1.01 1.02 -0.01

Precious Metals

Gold $1,553.70 $1,596.30 -$42.60

Platinum $1,523.00 $1,571.00 -$48.00

Stock Indexes Chng.

BSE 18,509.70 18,835.77 -326.07 -1.7%

Dow Jones 14,606.30 14,574.85 31.45 0.2%

FTSE 6,344.12 6,411.74 -67.62 -1.1%

Hang Seng 22,337.49 22,299.63 37.86 0.2%

S&P 500 1,559.89 1,568.94 -9.05 -0.6%

Yahoo! Jewelry 1,174.70 1,189.95 -15.25 -1.3%

Múdry sa teší objaveniu pravdy, hlupák falošnosti.

Rapaport Weekly Market Comment April 12, 2013

Polished diamond markets quiet with steady U.S. and Chinese demand. Rough selling at average 5% premium on secondary market, while increased supply calms price speculation. Cutters remain cautious and polished supply tight. Rapaport Melee Index +7% in 1Q 2013. Sotheby’s HK sells $61.4M (78.6% by lot) with round, 28.86ct., D, IF, 3X diamond selling for $6.9M (world record $239,532/ct.). Michael Hill sales +9% to $636M, same-store sales +2% for 9 months. U.S. Feb. polished imports flat at $1.5B, exports -8% to $1.5B. Japan’s Feb. polished imports +24% to $54M. JCPenney reappoints Myron Ullman as CEO. India’s Maharashtra State raises VAT on diamonds, precious metals to 1.1%.

RapNet Data: Apr. 11

Diamonds 982,794

Value $6,476,404,895

Carats 1,090,536

Average Discount -27.26%

www.rapnet.com

Get Current Price List | Subscribe to Rapaport | Join RapNet

RAPAPORT ANNOUNCEMENTS

April

9-17

Tue-Wed

Rapaport Melee Auction

New York & Dubai

View details

April

16-24

Tue-Wed

Rapaport Single Stone Auction

New York & Israel

View details.

QUOTE OF THE WEEK

Now JCPenney doesn’t look survivable. It’s in the process of disappearing but there may be a way to stabilize it -- slow the pace of pending], raise cash, sell stores, sell real estate -- the place is in complete catastrophe. The company needs a plan and to improve relationships with the financial community, suppliers and vendors.

Howard Davidowitz | Davidowitz & Assoc.

Careers@Rapaport

The Rapaport Group is growing rapidly. If you wish to work with the best and brightest, join us. We have great opportunities for trading managers, gemologists, sales assistants, and entry level positions for our offices in New York, Antwerp, Mumbai, Dubai, and Shanghai. View jobs now.

INDUSTRY

RMI +7% in 1Q13

The Rapaport Melee Index (RMI) for small diamonds increased 7% to 135.00 in the first quarter of 2013. While there has been a noticeable recovery since the third and fourth quarters of 2012, prices remain below last year’s when the RMI was 141.00. In the first quarter of 2013, prices showed consistent improvement and followed market confidence; however, there is concern that polished prices are being fueled by rough speculation rather than actual demand.

Rapaport’s first quarter Diamond Auctions sold over 130,000 carats for $25.1 million. More diamonds are being traded through the Rapaport auction platform even though there is a significant decline in second-hand recycled diamonds, with a 35% decline in gold sales due to lower gold prices.

De Beers Sight Estimate $650M

The De Beers April sight ended this past week with an estimated value of $650 million after the company raised prices by an average of 3%. Some boxes, including stones above 5 carats and 1 carat to 2 carat goods, increased by high single-digit percentages. De Beers boxes continue to sell at an average premium of about 5% on the secondary market. Sightholders expected a larger increase from De Beers, so speculation in the rough market has calmed since the sight closed. Biggest concerns remain low profit margins achieved in manufacturing. As a result, manufacturers are not increasing their output since the next two months are traditionally a quieter period in the polished market. Watch more on the year to date sight total.

RETAIL & WHOLESALE

Ullman Vows to Save JCPenney

Mike Ullman, JCPenneys rehired CEO, said his first priority would be to reconnect with the U.S. consumer in order to halt the retailers financial blood bath. Ullman, who was tapped over the weekend to take the post he held from 2005 to 2011, vowed to relay JCPenneys strong product value message, which he said was lost during Ron Johnsons relatively short tenure. JCPenney will return to the high-low pricing model, stabilize gross margin and reintroduce couponing and discounting. Ullman expects to emphasize the value of merchandise with competitive offerings by the back-to-school season, which hits in August. He plans to allow the transformation of JCPenneys home goods department as planned by May, but then hold off on any further incorporation of stores within a store, which was one of Johnsons expensive initiatives.

March Retail Sales Growth Falls Short

U.S. chain-store sales posted a modest gain of 1.6% year on year for the fiscal month of March, according to the International Council of Shopping Centers (ICSC). The comparable-store sales performance during the month, which included the Easter weekend, was far below ICSC Research’s expectations. The group blamed cooler weather across much of the U.S. for weak consumer spending. ICSC research anticipates that same-store sales in April will rise between 2% and 3%

Sothebys Jewels Sale Nets $61M

Sotheby’s Hong Kong sale of magnificent jewels and jadeite generated $61.4 million with high-end white diamonds dominating the top lots. The auction sold 78.6% by lot with the top lot an un-mounted brilliant cut, 28.86-carat, D, flawless diamond that sold for $6.9 million, or a record $239,351 per carat, to a private Asian buyer. The second top lot was pendent earrings weighing 8 carats each, which sold for $2.8 million, or $239,352 per carat, also to a private buyer from Asia.

Michael Hill Sales +9%

Michael Hill International reported that sales for the first three quarters of the fiscal year, which included actual totals for the first eight months plus preliminary results for March, rose 8.8% year on year to $363 million. Same-store sales rose 2.2 percent. By region, stores sales rose 11.4% in Australia to $233 million, while same-store sales increased 4.2 percent; in New Zealand, revenue climbed 3.6% to $74 million and same-store sales were up 3.1% and in Canada, sales surged 20.6% to $33 million with comparable-store sales only 2.8% higher. In the U.S., revenue and same-store sales rose 7.7% to $7.7 million.

Kendra Scott Opens New Boutique

Kendra Scott plans to open at Fashion Island in Newport Beach, California on April 15. The boutiques façade will boast the signature Kendra Scott medallion, while the interior will feature a Danielle display table and space for in-store entertaining with a full kitchen. The boutique will include the signature Kendra Scott Color Bar, with a 55-inch touch-screen display monitor, iPads and a kaleidoscope of 26 gemstones and 23 jewelry silhouettes to provide an interactive experience to guests.

H.Stern Opens Stand-Alone Store

H.Stern opened its first stand-alone jewelry boutique in the U.K. on Sloane Street in London. H.Stern is also located at Harrods in the fine jewelry room. The new H.Stern boutique showcases the brand’s signature jewelry collections such as Stars (Stern means star in German and is H.Stern’s visual icon), Fluid Gold, Moonlight and Copernicus. The space covers 156 square meters and incorporates what the retailer considered to be elegant curves for its furniture and interior design, to reveal a feminine silhouette of the "S" in the H.Stern logo.

Maharashtras VAT Rises to 1.1%

India’s Maharashtra State government raised the rate of value added tax (VAT) for diamonds and precious metals sold in the state on April 1 from 1% to 1.1%. The directive continues through March 31, 2014. The same increase applies to precious metals, including gold, silver, platinum, osmium, palladium, rhodium and ruthenium, as well as articles made from precious metals of fineness not less than 50%.

Zales Bumps Tiffany on Affluent Survey

Post-recession growth has not been uniform across income segments, according to Unity Marketing, which determined that it is the top 20% of earners, or 24.2 million households, who are driving the recovery. But even more interesting from the data is that ultra-affluents, or those earning $250,000 or more annually, are spending less on luxury goods, especially jewelry and watches.

Spending increases are coming from those making $100,000 to $249,999 per year, or a group Unity labels the HENRYs -- high earnings, not rich yet -- and they account for 21.8 million households. In Unity Marketings latest analysis, Luxury Report 2013, ultra-affluents are behaving more like the HENRYs as they have reduced purchases on luxury items and even the high-income ultras are trading down to less premium brands. One such example the report noted was that affluent consumers chose Zales over Tiffany this year as ultra-affluents jeweler of choice.

Furthermore, in 2012, Unity found that only 58.4% of affluents purchased jewelry this past year, down from 75.7% in 2011; and 70.6% purchased watches compared with 88.6% in 2011. Double-digit declines in spending were also observed for clothing, fashion accessories and premium beauty products, according to Unity Marketing. The group warned marketers to prepare for selective purchases by affluents as these consumers make tradeoffs to maximize the emotive and luxury return on that investment.

Sterling, Zale Pick Mediator

Plaintiff Sterling Jewelers and defendant Zale Corporation selected a mediator in the case challenging Zales Celebration Diamond as the most brilliant in the world. The rival retailers picked Charles Lyon, of Calfee, Halter & Griswold of Cleveland, Ohio to head up the negotiations. An initial conference is planned for May 2.

OECD Heads Up Due Diligence Guidance

The Organization for Economic Cooperation and Development (OECD) is weighing projects intended to support due diligence guidance for the responsible supply chain of minerals, including diamonds, from conflict-affected and high-risk areas of the world. Various parties, including the Responsible Jewellery Council (RJC), will meet in Paris to examine case studies, discuss activities underway from stakeholders and other proposals to improve artisanal mining. RJC extended the invitation to industry members to learn more or become involved by contacting Fiona Solomon, the director of RJCs standards development.

RJC is a member of the OECD-hosted multi-stakeholder Interim Governance Group for due diligence guidance along with the London Bullion Market Association (LBMA), the World Gold Council (WGC), civil society and governments.

MINING

Dominion Closes Ekati Sale

Dominion Diamond Corporation, formerly Harry Winston Diamond Corporation, completed its planned acquisition of the Ekati diamond mine, which included associated diamond sorting and sales facilities in Yellowknife, Canada and Antwerp. Ekati consists of a core zone, which includes the current operating mine and other permitted kimberlite pipes, as well as a buffer zone, an adjacent area hosting kimberlite pipes having both development and exploration potential. Dominion Diamond purchased the assets from BHP Billiton for $553 million and it officially marks the end of BHPs diamond investment.

Ekati held cash of approximately $65 million on the closing date and two sales cycles (10 weeks) of diamond inventory either in the process of being sorted and valued or available for sale. Dominion Diamond expects to release a detailed mine plan for Ekati on or before April 24.

ZMDC Blames Closed Mines on Funding

Zimbabwe’s Mines & Mining Development Deputy Minister, Gift Chimanikire, accused the Zimbabwe Mining Development Corporation (ZMDC) of "gross incompetence” over its failure to reopen closed mines. However, ZMDC’s managing director, Jerry Ndlovu, claimed it is inhibited from reopening mines due to limited lines of credit since Western sanctions restrict cash flow, and due to the exorbitant financing requirements of refurbishing mines.

In other news, the government denied it had issued diamond exploration licenses in the Bikita, Masvingo area, despite contrary reports. It also remained unaware of how Nan Jiang Africa Resources had set up to mine diamonds in the region without a license or approval.

Meanwhile, Ahmed bin Sulayem, the executive chairman of the Dubai Multi Commodities Centre (DMCC), chided Western countries for placing sanctions on Zimbabwe, saying sanctions were denying Zimbabwe its “lifeblood.” He was addressing a DMCC precious metals conference underway in Dubai.

CAR Diamonds Funded Rebels

Some diamond miners in Central African Republic (CAR) told Radio France Internationale that they funded the Seleka Coalition, which seized power and overthrew President Francois Bozize on March 24. Traders claimed that Bozize created enemies by seizing their diamonds and cash since 2008, none of which has been returned to the diamond miners. While Bozize fled to Cameroon this past week, no one has acknowledged where the seized goods reside. Some traders confessed that they were charged with going into Sudan to sell rough diamonds and their stockpiles in CAR were also confiscated.

UN Progresses on Security in Cote dIvoire

Security remains a priority in Côte d’Ivoire ahead of local elections on April 21 and following an outbreak of violence in March. The UN Operation in Côte d’Ivoire (UNOCI) will assist with security in the region, as well as address the sources of this new round of conflict. Blue helmets have deployed to Petit Guiglo and are supporting Ivorian forces and protecting civilians through ground and air patrols. UNOCI provides technical support to the polls through the independent electoral commission. It has also supported the reunification and stabilization of Cote dIvoire, which remains under a rough export ban by the Kimberley Process. Economic growth in Cote d’Ivoire is predicted to reach 9% this year.

Aikhal Reaches Design Capacity

ALROSA’s Aikhal underground mine has reached its design capacity of 500 thousand tonnes of ore per year. Aikhal is expected to produce 2.5 million carats of rough diamonds per year at full capacity. The Aikhal pipe is one of ALROSAs oldest deposits and contains more than 14 million carats of rough diamonds, with inferred and indicated resources of more than 54 million carats, according to a 2012 JORC-compliant audit.

Zambia Constrains Gemfields

Gemfields is seeking an exception to Zambias rule of selling emeralds in local currency, and has engaged the Bank of Zambia to permit trading in U.S. dollars. Zambia prohibited quoting and pricing gems and other items in foreign currency almost one year ago. Gemfields, which operates the Kagem emerald mine in Zambia, would invoice outside buyers in dollars and Zambian buyers in local currency.

Meanwhile, Gemfields is also facing a possible ban of even selling its gemstones outside of Zambia. Forcing all buyers to come into Zambia for an emerald auction would be detrimental and prevent the firm from freely selling goods on the open market, according to a note the company sent to shareholders. Gemfields had already agreed to include Zambia as one of several auction destinations this year.

Renard 65 Valuation Returns $250 Per Ct.

Stornoway Diamond Corporation reported the Renard 65 bulk sample of rough diamonds, valued by WWW International Diamond Consultants, held an average price of $250 per carat. The diamond price model for Renard 65 is now $180 per carat, with a high sensitivity of $203 per carat and a minimum sensitivity of $169 carat. The bulk sample valuation included two higher-value stones, a 9.77-carat, G diamond of $8,500 per carat and a 6.40-carat, F diamond of $5,900 per carat.

Botswana Diamonds Adds License

Botswana Diamonds added another license to its option agreement with a Mozambican company, Morminas, a subsidiary of the EIP Group of Portugal. This brings the total to three license blocks that are being evaluated on the Save River in Mozambique, close to the Zimbabwean border. The Save River runs southeastwards and drains from the Marange diamond fields. The agreement stipulates a six-month exclusive period during which Botswana Diamonds will review the available data on the licenses and undertake preliminary exploration.

ECONWATCH

Diamond Industry Stock Report

pastingU.S. retailers were mostly higher, Movado and Signet (+5%), Sothebys (+7%) and Zale (+9%) led the way. European and Indian shares were mixed and mostly unchanged. Mining shares were trading lower, Rockwell, Shore Gold and Gemfields all down by more than 10%. View the extended stock report.

$1 = Euro 0.760 0.770 -0.010

$1 = Rupee 54.27 54.89 -0.6

$1 = Israel Shekel 3.63 3.62 0.01

$1 = Rand 8.90 9.15 -0.25

$1 = Canadian Dollar 1.01 1.01 0.00

Precious Metals

Gold $1,561.00 $1,553.70 $7.30

Platinum $1,532.00 $1,523.00 $9.00

Stock Indexes Chng.

BSE 18,542.20 18,509.70 32.50 0.2%

Dow Jones 14,864.83 14,606.30 258.53 1.8%

FTSE 6,416.14 6,344.12 72.02 1.1%

Hang Seng 22,101.27 22,337.49 -236.22 -1.1%

S&P 500 1,593.35 1,559.89 33.46 2.1%

Yahoo! Jewelry 1,196.04 1,174.70 21.34 1.8%

Múdry sa teší objaveniu pravdy, hlupák falošnosti.

Rapaport Weekly Market Comment April 19, 2013

Plunging gold prices have not yet impacted diamond prices or demand. Strong demand and very high prices for exceptional diamonds and jewelry at Christies and Sothebys NY auctions. Sharply lower gold prices have created surging demand in China with shortages of jewelry before important May Day holiday. Basel show expectations mixed. Christie’s NY sells $81M (82% by lot) with cushion-cut, 34.65ct., fancy intense pink diamond sold for $39M ($1.14M/ct.). Sotheby’s NY sells $54M (82% by lot) with pear-shape, 74.79ct., D, VVS1 sold for $14M ($189,397/ct.). Rio Tinto’s 1Q diamond production -4% to 3.2M cts. Belgium’s March polished exports -12% to $1.2B, rough imports -13% to $1.2B.

RapNet Data: Apr. 18

Diamonds 968,713

Value $6,269,107,512

Carats 1,066,517

Average Discount -27.19%

www.rapnet.com

Get Current Price List | Subscribe to Rapaport | Join RapNet

RAPAPORT ANNOUNCEMENTS

April

16-25

Tue-Thu

Rapaport Single Stone Auction

New York & Israel

View details.

Apr-May

30-8

Tue-Wed

Rapaport Melee Auction

New York & Dubai

View details.

June

2

Sun

Rapaport Breakfast & Conference at JCK

Mandalay Bay Resort

8 a.m. to 10 a.m. -- South Seas Ballroom, breakfast and Martin Rapaports State of the Diamond Industry presentation.

10:30 a.m. to 12:30 p.m. -- Banyan Ballroom, Rapaport Certification Conference with RapNet insights into grading reports.

2 p.m to 4:30 p.m. -- Banyan Ballroom, Rapaport Fair Trade Jewelry Conference.

Register now, or email conference@diamonds.net or call 1.702.893.9400, these events are free but seating is limited.

QUOTE OF THE WEEK

The truly exceptional 74.79-carat stone was a thrill to auction at Sothebys New York and exemplifies the strength of the market for white diamonds over the last decade. It was acquired by the present owner in 2001 for $4.3 million, and today sold for a record $14.2 million.

Lisa Hubbard | Sothebys Intl. Jewelry Division

Careers@Rapaport

The Rapaport Group is growing rapidly. If you wish to work with the best and brightest, join us. We have great opportunities for trading managers, gemologists, sales assistants, and entry level positions for our offices in New York, Antwerp, Mumbai, Dubai, and Shanghai. View jobs now.

INDUSTRY

Princie Diamond Sells for $39M

WATCH NOW: Christie’s spring auctions started off with a bang as its New York sale garnered $81,358,700, a total not generally seen in the City. The sale got a big boost from the top lot The Princie Diamond, a 34.65-carat cushion cut, fancy intense pink Golconda diamond which sold to a deep pocketed anonymous buyer for $39,323,750 or $1,135,000 per carat.

The round of bidding went quickly and was sold to a bidder on the phone manned by none other than Christie’s managing director and head of worldwide jewelry, Francois Curiel himself. There was steady bidding at the sale with most items staying within the estimate, in a room filled with buyers and dealers who had come to find out how the big diamonds and the Princie would fare.

Sothebys Jewels Auction Tops $54M

WATCH NOW: Sothebys New York sale of magnificent jewels garnered $53,490,938 and was 82.4% sold by lot. The top lot was a 74.79-carat, D, VVS1 potentially internally flawless, type IIa, pear-shaped diamond that sold for $14.165 million. The diamond was acquired in 2001 for $4.3 million. Other highlights included a 21.46-carat, D, internally flawless, type IIa emerald-cut diamond ring that sold for $3.189 million, while a 22.48-carat emerald and diamond brooch fetched $2.909 million.

Speculators Trigger Price Drop

The World Gold Council issued a statement saying the fall in gold prices was triggered by speculative traders operating in the futures markets with a short-term goal of generating a trading profit. The group added that a surge in gold purchases is spanning markets from India and China to the U.S., Japan and Europe. Buyers are viewing this as an opportunity to purchase gold at prices not seen in the past couple of years. Since gold operates on the basic economic fundamentals of demand and supply, the groups view is that demand is strong, while supply remains constrained, and that this dynamic ultimately drives the long-term price of the metal.

RETAIL & WHOLESALE

Swiss Watch Exports -3%

Swiss watch exports fell 2.5% year on year to $1.73 billion in February due mainly to softer demand from China and Hong Kong, according to the Federation of the Swiss Watch Industry. Exports of wristwatches declined by 2% to $1.62 billion, with the number of units down 15% to 1.027 million. The value of other products dropped 10% to $103.7 million. Exports to China fell 34%, while they were 24% lower in Hong Kong. During January and February, total Swiss watch exports increased 4% to $3.32 billion.

Jewelry Store Sales +4%

U.S. jewelry store sales rose 3.8% year on year in February to $2.756 billion, which was a new high for the month. In addition, the consumer price inflation (CPI) for jewelry fell 3%. Additionally, Januarys sales figure was revised $20 million lower than earlier estimates to $1.934 billion, representing a year-on-year increase of 13.5%. For the first two months of 2013, U.S. jewelry store sales have risen a healthy 7.6% to $4.69 billion and the CPI has fallen by almost 4%.

Jewelry CPI -3%

The U.S. consumer price index (CPI) for jewelry eased again in March, falling 2.9% year on year to 176.1 points in response to weaker prices for precious metals. The index was a touch higher than Februarys reading of 175.9 points. Nonetheless, the CPI maintained a historically strong trend, with March representing the 27th consecutive month of a reading of more than 170 points. With the recent and dramatic drop in gold prices this month, that trend may break with Aprils report.

Lazare Kaplan Sales -31%; Sues ADB

Lazare Kaplan International Inc. notified the Securities and Exchange Commission (SEC) that it would again be filing a quarterly financial report late for the fiscal period that ended on February 28. Nonetheless, it estimated that revenue for the fiscal third quarter fell 31% year on year to $15.3 million, while sales for the first nine months of the fiscal year slipped 38% to and $50.2 million.

Lazare Kaplan has been unable to file its quarterly and fiscal-year financial statements since September 2009 due to unresolved material uncertainties concerning, among other things, ongoing litigation with Antwerp Diamond Bank (ADB) N.V. and KBC Bank N.V. Lazare Kaplan has appealed the dismissal of a $500 million Racketeer Influenced and Corrupt Organizations Act (RICO) complaint against the banks in the U.S., and on March 21 it filed criminal proceedings against Antwerp Diamond Bank in Antwerp, alleging fraud, embezzlement and money laundering. Proceedings are scheduled to commence on May 3.

Care Reafirms Rating on Rajesh Exports

Care Ratings reaffirmed its A3+ rating on Rajesh Exports Ltd. short-term fund and non-fund bank facilities of $118 million (Rs. 640 crore.) Care drew ratings strength from Rajesh Exports rank as a top manufacturer and exporter of gold jewelry, a for its strong management and in-house design teams. The rating was constrained by low profit margins, geographical and client concentration risks and working capital intensive nature of the companys operations.

The Seamless Shopping Experience

Retailers that deliver on their customers’ expectations by providing a seamless shopping experience – including in store, online and through a mobile device – will win loyalty and gain a competitive advantage, according to the Accenture Seamless Retail Study.

The study also concluded that half of consumers believe the best thing retailers can do to improve the shopping experience is to better integrate channels, while 89% of consumers said it is important for retailers to let them shop for products in the way that is most convenient, no matter which sales channel they choose.

Furthermore, 82% of consumers stated they want retailers to provide information on current product availability; however, only 21% of retailers offered that service, according to Accenture.

GENERAL

Fairtrade, Fairmined Gold Label Splits

The Alliance for Responsible Mining (ARM) and Fairtrade International (FLO) will not renew their partnership contract with Fairmined and Fairtrade gold, so the original agreement will end on April 22 and the standards and label will split into two different systems. Only the Fairtrade Mark will be used for precious metals after that date, which all parties involved believe is more consumer friendly. FLO and ARM jointly launched Fairtrade and Fairmined gold in the U.K. in 2011. ARM, which will maintain the Fairmined scheme moving forward, believes that artisanal and small-scale mining is increasingly being recognized as a sector that presents real development opportunities for impoverished communities worldwide and is at the heart of global development.

Endiama Hosts June Conference

Endiama is organizing the Angolan Diamond Centenary Conference 2013 in Luanda on June 20 and 21. Participants so far include ALROSA, the World Diamond Council, the Dubai Multi Commodities Centre, the Gem & Jewellery Export Promotion Council, the Shanghai Diamond Exchange, the New York Diamond Dealers Club and representatives from the Kimberley Process. The conference aims to highlight the accomplishments of Angola in the diamond industry, emphasize its potential and announce new Mining Law incentives for investors.

MINING

Zimbabwe Earns $5M From Diamond Revenue

Zimbabwes Finance Minister Tendai Biti said diamond miners should remit at least 50% of their revenue to the government to help boost economic activity. Biti said that diamonds produced no revenue in January or February, but in March, the government received $5 million against a target of $15 million. In 2012, Biti anticipated diamond revenue of $600 million, but only received $41.6 million. He added that diamond exports in March amounted to $114 million, with Mbada Diamonds contributing $44.7 million followed by Anjin Investments at $30 million and Diamond Mining Corporation at $18 million.

Petra Recovers High-Quality Blue Stone

Petra Diamonds recovered a high-quality, top-color 25.50-carat blue diamond from its Cullinan mine in South Africa. The company is currently implementing an expansion plan at Cullinan, which will take production from 870,000 carats per year in 2012 to a projected 5 million carats per year by the end of 2019.

Ekati Production -26%

BHP Billiton reported that production at the Ekati diamond mine in Canada fell 26% year on year to 322,000 carats in the third fiscal quarter that ended on March 31. Ekati production is down 32 percent to 930,000 carats during the first nine months of the fiscal year. BHP Billiton completed the sale of its stake in Ekati to Dominion Diamond Corporation on April 10 for $553 million, marking its exit from the diamond sector

Diavik Production +21%

Dominion Diamond Corporation, formerly Harry Winston Diamond Corporation, reported that diamond production at the Diavik diamond mine in Canada rose 21% year on year to 1.9 million carats during the first quarter, which ended on March 31. The increase was primarily due to improved grades in each of the kimberlite pipes as the average measurement rose to 3.87 carats per tonne, compared with 3.03 carats per tonne of ore one year ago.

A new mine plan and budget for calendar 2013 has been approved by Dominions partner, Rio Tinto, and they anticipate the Diavik diamond mine will produce approximately 6 million carats, up almost 40% from the previous year. Mining activities will be exclusively underground.

Rio Tinto Production -4%

Rio Tintos diamond production fell 4% year on year to 3.24 million carats for the first quarter that ended on March 31. The companys Argyle diamond mine in Australia produced 1.99 million carats, representing a year-on-year decline of 15%. Rios share of Diaviks production surged 21% to 1.167 million carats and the Murowa diamond mine in Zimbabwe improved production by 20% year on year to 79,000 carats.

Rockwell Restarts Niewejaarskraal

Rockwell Diamonds Inc. will invest capital from the sale of its Klipdam diamond mine into bringing the Niewejaarskraal diamond mine back to production and for growing the companys mining footprint in the Middle Orange River region of South Africa. Rockwell sold Klipdam and its associated properties for $5.2 million to a private alluvial diamond miner in three tranches, or payments. The first tranche was received upon signing the deal, and the remaining purchase price will be paid to Rockwell in eight monthly installments. Klipdam included the contiguous Holpan 161 and Klipdam 157 farms, covering an area of 3,836 hectares, as well as prospecting properties Erf 1 and Erf 2004, Windsorton.

The companys board approved a $2 million budget to take Niewejaarskraal out of care and maintenance operations. The project entails bringing the dense media-separation plant into operation and production will be supplemented through the addition of four rotary pans from the Tirisano mine in addition to using equipment from Klipdam that was not part of the sale. Trial mining operations are expected after a six-month implementation phase.

STATS

Belgium

Mar. $Mil. %Chng. YTD $Mil. %Chng.

Polished exports $1,214 -12% $3,349 -6%

Polished imports $1,268 -3% $3,216 -13%

Net exports ($54) $133

Rough imports $1,184 -13% $3,455 -1%

Rough exports $1,405 -4% $3,583 -1%

Net imports ($221) ($128)

Net diamond account $167 -3% $261

ECONWATCH

Diamond Industry Stock Report

Widspread declines were observed in industry stocks with Movado, Saks, Sothebys, Zale, Classic Diamond and Chow Sang Sang hit the hardest on the retail side, while Dominion, Peregrine, Rockwell, True North, Firestone and Stellar all down by double-digits for mining investors. View the extended stock report.

Apr. 18 Apr. 11 Chng.

$1 = Euro 0.760 0.760 0.000

$1 = Rupee 54.02 54.27 -0.3

$1 = Israel Shekel 3.63 3.63 0.00

$1 = Rand 9.19 8.90 0.29

$1 = Canadian Dollar 1.03 1.01 0.02

Precious Metals

Gold $1,388.00 $1,561.00 -$173.00

Platinum $1,424.00 $1,532.00 -$108.00

Stock Indexes Chng.

BSE 19,016.46 18,542.20 474.26 2.6%

Dow Jones 14,539.29 14,864.83 -325.54 -2.2%

FTSE 6,243.67 6,416.14 -172.47 -2.7%

Hang Seng 21,512.52 22,101.27 -588.75 -2.7%

S&P 500 1,541.70 1,593.35 -51.65 -3.2%

Yahoo! Jewelry 1,161.24 1,196.04 -34.80 -2.9%

Múdry sa teší objaveniu pravdy, hlupák falošnosti.

Rapaport Weekly Market Comment April 26, 2013

Cutting centers very quiet with liquidity problems developing in India. Booming Chinese demand for gold jewelry follows sharp gold price plunge with retailers focusing on gold instead of diamonds for important May Day holiday. Large stone market doing well following successful auctions with positive expectations for Basel show. Rough trading stable with less speculation. De Beers 1Q production +3% to 6.2M cts. Gem Diamonds 1Q Letšeng rough sales -20% to $47M with average price -19% to $1,599/ct. Luk Fook’s 1Q China same-store sales +14%, Hong Kong, Macau +29%. Bonhams London sells rare, 5.3ct., fancy deep-blue diamond to Graff for $9.5M ($1.8M/ct.).

RapNet Data: Apr. 25

Diamonds 984,193

Value $6,356,711,252

Carats 1,083,416

Average Discount -27.27%

www.rapnet.com

Get Current Price List | Subscribe to Rapaport | Join RapNet

RAPAPORT ANNOUNCEMENTS

Apr-May

30-8

Tue-Wed

Rapaport Melee Auction

New York & Dubai

View details.

May

16-22

Thu-Wed

Rapaport Single Stone Auction

Israel

View details.

June

2

Sun

Rapaport Breakfast & Conference at JCK

Mandalay Bay Resort

8 a.m. to 10 a.m. -- South Seas Ballroom, breakfast and Martin Rapaports State of the Diamond Industry presentation.

10:30 a.m. to 12:30 p.m. -- Banyan Ballroom, Rapaport Certification Conference with RapNet insights into grading reports.

2 p.m to 4:30 p.m. -- Banyan Ballroom, Rapaport Fair Trade Jewelry Conference.

Register now, or email conference@diamonds.net or call 1.702.893.9400, these events are free but seating is limited.

QUOTE OF THE WEEK

For small businesses, there is nothing fair about the Marketplace Fairness Act. The U.S. legislation stems from a fight between big bricks-and-mortar national retailers and big online retailers, all of whom seem unconcerned that small enterprises—and the jobs they create—are going to be collateral damage.

John Donahoe | eBay Inc.

Careers@Rapaport

The Rapaport Group is growing rapidly. If you wish to work with the best and brightest, join us. We have great opportunities for trading managers, gemologists, sales assistants, and entry level positions for our offices in New York, Antwerp, Mumbai, Dubai, and Shanghai. View jobs now.

INDUSTRY

ALROSAs Board Approves Dividend

ALROSAs supervisory board approved holding the companys general meeting of shareholders on June 29, at which time parties will vote on approving the companys annual report and financial statements, including profit and distribution of dividends. Earlier in the week the executive committee proposed dividends of RUB 1.11 per share, which the supervisory board agreed to put to shareholder vote. Full year profit, without revaluation of financial investments, amounted to $810 million (RUB 25.2 billion) and the board recommended allocating $263 million (RUB 8.18 billion) for dividends. Russia requires companies whose shares are in federal ownership to allocate at least 25% of the profit to dividends.

The supervisory board also reduced ALROSA’s executive committee to 13 members, terminating Vassily Grabtsevich, Dmitry Voyan, Valery Kornilov, Mikhail Lopatinsky, Elena Timonina, Vladimir Tkachenko, Igor Uvarov and Rishat Yuzmukhametov. Alexander Matveev, the head of ALROSA’s legal department, was appointed to the committee.

eBay Proposes Exemption to Save Small Businesses

John Donahoe, the CEO of eBay, proposed an exemption for small business in the Internet sales tax bill, commonly known as the Marketplace Fairness Act, claiming in an op-ed piece for the Wall Street Journal that the weight of collecting sales taxes will overburden small firms that are trying to survive and expand online. He also said that well-heeled lobbyists who represent major retailers refuse to accept a compromise in support of small business. The National Retail Federation (NRF) and Jewelers of America (JA), to name two, both support the new sales tax bill.

The Internet tax scheme stems from a fight between big retailers and smaller brick-and-mortar stores who are eager to end tax-free shopping online in the U.S. Donahoe contends that the bill treats mom-and-pop businesses equal to corporate behemoths such as Macys, Walmart and Amazon.com all of which have internal resources to collect taxes for 9,600 jurisdictions in the U.S.

He argued that, while its fair for a small business to collect local online sales taxes for their own jurisdiction, requiring them to collect taxes on behalf of all 50 states is not only difficult, if not impossible, but will force them to abandon the Internet sales channel. Auction site eBay is advocating that the bill include an exemption for businesses with fewer than 50 employees or with less than $10 million in annual out-of-state sales

RETAIL & WHOLESALE

Blue Diamond Sells for $10M

Bonhams London sold an extremely rare 5.30-carat, fancy deep-blue diamond for $9.5 million (GPB 6.2 million), or $1.8 million per carat, to Graff. The auction house stated that bidding on this gemstone came from around the world through 25 telephone lines as well as from those in the packed saleroom. The cushion-shape blue diamond is set horizontally with a mount pave-set with brilliant-cut diamonds and course of baguette-cut diamonds in a Trombino ring made by Bulgari, circa 1965. The ring had a high presale estimate of $2.3 million.

U.S. Chain-Store Sales +2%

U.S. chain-store sales rose 1.9% year on year for the week that ended on April 20, according to the International Council of Shopping Centers (ICSC) and Goldman Sachs. The week-to-week change in comparable-store sales reflected a slight increase of 0.8%. Sales were mixed with improved performance at grocery stores and discounters, but weaker business for electronics, office, apparel, department, drug and other specialty stores.

Tiffany Seeks Dismissal of Counterclaim

Attorneys for Tiffany & Co. filed a motion with the U.S. District Court to dismiss Costco Wholesale Corporations counterclaim concluding that the ‘‘Tiffany setting is generic and unenforceable as a trademark. Costco isnt seeking to use a mark similar to ‘‘Tiffany, but it is asking the court to declare everyone is free to use the identical mark for certain jewelry products, according to the plaintiffs attorneys.

Tiffany & Co. argued that entertaining Costcos counterclaim sanctions counterfeiting of certain items even though the incontestable mark would remain for other products, even within the class subcategory of “jewelry.” Furthermore the court has no authority to invalidate an incontestable, fanciful trademark for use in just one product class.

While Tiffany has not specifically trademarked the term Tiffany setting, the trademarked word Tiffany identifies the companys product, which is an exclusive right, whether a noun or adjective. Tiffany & Co. sued Costco in February alleging the defendant knowingly and willfully violated its trademark by promoting and selling rings as ‘‘Tiffany,’’ when in fact the rings were not made by Tiffany & Co., according to both parties. Costco sought to have the case dismissed on the grounds that the Tiffany setting should be generic.

Ben Bridge Adds Collection to Ikuma Brand

Ben Bridge Jeweler unveiled a new bridal collection under its Ikuma brand, which was built upon the retailers ethically sourced diamond marketing campaign. Ikuma diamonds originate from the Diavik diamond mine in Canada and where named after the Inuit word for fire. The American Gem Society (AGS) Laboratory certifies Ikuma diamonds for Ben Bridge. The retailer stated that Ikuma Canadian diamond engagement rings and wedding bands are designed to meet the needs of socially conscious brides and grooms.

The New Normal Hits LVMH

Ultra-affluent consumers in the U.S., those in the top 2% of households, are trading down to less premium brands, according to research firm Unity Marketing. The trend took hold during the Great Recession and its remains firmly in place with affluent consumers to this day. Recent sales growth figures from LVMH, for example, further confirmed Unitys findings, and the consulting firm warned luxury goods makers not to be among those rudely awakened to the new normal as revenue growth slows.

The core customers of luxury goods brands are looking to maximize their investment buying branded goods and yet too many retailers, including LVMH, arent measuring up for true, lasting value, according to Unity. Simply promoting a storied brand name no longer works in the new normal, according to Unitys president, Pam Danziger.

Luxury brands have to deliver important values to their affluent customers, who have the means to purchase across a wide range of choices, she said. Luxury goods makers must realize that while affluent shoppers have plenty of cash to spend, they arent about to pay high prices for goods that dont measure up to their exacting standards for quality, workmanship, materials and design. Brands such as Louis Vuitton, which has grown ubiquitous lately, have gone off point with ultra-affluent customers by becoming too popular with the masses, Unity found.

Unitys most recent spending report tracked that ultra-affluents, the most important customer segment for high-end products, severely reduced purchases in 2012 for watches and jewelry, as well as clothing, fashion accessories and beauty products. These consumers have found substitutes with less premium brands and they are shopping more strategically to find bargains, according to the firms research.

Univ. Honors Alex & Ani Execs

The University of Rhode Island will recognize the jewelry store owners of Alex and Ani, Giovanni Feroce, a 1991 graduate and the CEO, and company founder and creative director, Carolyn Rafaelian, with honorary Doctorate of Business degrees during commencement ceremonies in May. Feroce (pictured) is expected to present a commencement address as well for the universitys 127th graduation ceremony. Feroce and Rafaelian join three other business leaders chosen by the university to receive honorary degrees for business acumen and for making a significant impact on the states economy.

Lazare Kaplan Wins Appeal

The United States Court of Appeals for the Federal Circuit reversed and earlier court ruling that invalidated a summary judgment against plaintiff Lazare Kaplan International by defendants Photoscribe Technologies Inc. and the Gemological Institute of America (GIA) in a patent infringement case. The court remanded the suit to the District Court with instructions to assess patent infringement by the defendants and, if necessary, determine damages.

U.S. Approves Forevermark Diamond Institute Trademark

The U.S. Patent & Trademark Office (USPTO) issued the trademark Forevermark Diamond Institute to De Beers Centenary of Switzerland on April 23, with the registration number of 4324606. De Beers filed for the trademark on June 16, 2011. The description of the trademark includes the words Forevermark Diamond Institute inside an outer circle with two black dots adjacent the word Forevermark.

There is an inner circle within the outer circle and that inner circle contains the view of a diamond from above. The goods and services provided under this trademark cover scientific and technological developments through research and design in the fields of minerals and gems; industrial analysis and research services in the fields of minerals and gems; design and development of computer hardware and software all relating to the grading, identification, observation, measuring, testing, checking, analysis, inspection, inscription for the purpose of certifying diamonds, jewelry, precious and semi-precious stones.

Most Affluents to Hold Firm on Jewelry Spending