Příspěvky: 22 583

Zaregistrován

23. 10. 2006

RAPAPORT

Market Comment

March 21, 2024

News: Market slow but stable. Polished production rising, with India Feb. rough imports at 11-month high of $1.6B (-6% YOY), polished exports $1.7B (-28% YOY). Rapaport sends letter to OFAC requesting exemptions for polished diamonds in the US and all polished diamonds in existence before March 1, 2024. There should not be sanctions for polished diamonds that do not result in additional funding to Russia. Botswana warns that G7 sanctions might harm its diamond industry. US Federal Reserve holds interest rates at 5.25% to 5.5% after 3.2% inflation in Feb. Signet shares -12% in one day amid soft 1Q guidance; fiscal 4Q sales $2.5B (-6% YOY), profit $626M (+126%). Brilliant Earth 4Q sales $124M (+4% YOY).

Fancies: High inventories of Ovals and Pears due to slow sales and imbalance between supply and demand after Indian manufacturers shifted from rounds to fancies last year. Cutters now returning to rounds. Sellers are flexible on prices. Downtrend continues. Weakest size is 0.70 ct. category. Sales of Hearts, Princesses and square Cushions low. Longer Ovals, Pears, Radiants and Cushions bringing higher prices. Goods with medium and short ratios harder to sell. Supply shortages supporting prices for Marquises. Well-cut stones hard to find and commanding premiums. Oversizes trading at higher prices than usual. Off-make, poorly cut fancies illiquid.

United States:

Market quiet. Jewelers cautious about buying for inventory. Steady demand for round, 1.75 to 2.99 ct., F-H, VS2-SI2, RapSpec A3 diamonds, with some shortages. Elongated ovals and marquises doing well.

Belgium:

Trading slow. Customers not purchasing for inventory. Concerns remain about impact of G7 sanctions on supply chain. Steady demand for diamonds under 0.30 ct., but 1 to 3 ct. weak. Buyers focusing on cut quality, with fancies only selling if the make is perfect.

Israel:

Sentiment weak amid sluggish demand from US and China. Steady orders for premium, RapSpec A3+ diamonds.

India:

Activity down, with few orders from US, Chinese and domestic markets. Stable demand for 1 to 1.99 ct., G-H, VS-SI, RapSpec A3+, but VVS weaker. Small diamonds cooling as Indian wedding season ends.

Hong Kong:

Market in traditional low season. Jewelry manufacturing on mainland has slowed. Chinese shoppers moving away from diamonds toward lower-cost materials. Gold sales stronger, with young consumers viewing it as good investment.

Múdry sa teší objaveniu pravdy, hlupák falošnosti.

Příspěvky: 1 147

Zaregistrován

4. 7. 2016

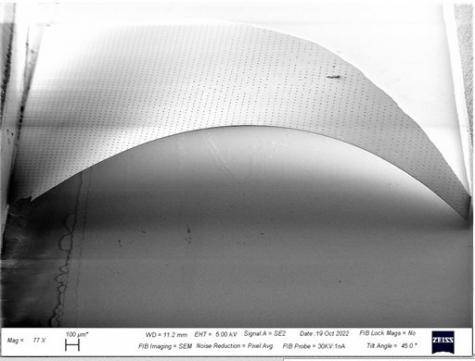

Tým Fraunhofer vyvinul extrémně tenké flexibilní membrány ze syntetických diamantů ( 1 mikrometr) . Vzhledem k jednoduché výrobě (růst na křemíkové podložce) je bude možné produkovat v průmyslovém měřítku.

Diamant skvěle vede teplo, ale zároveň je elektrický izolant. Diamantové membrány mohou snížit tepelnou zátěž elektronických komponent až desetinásobně. To následně podstatně zvýší energetickou účinnost a prodlouží životnost komponent i celého elektronického zařízení.

Obrázky:

Příspěvky: 1 147

Zaregistrován

4. 7. 2016

Nanodiamanty

Jedná se o extrémně malé diamanty o velikosti mezi 5 až 100 nanometry, tedy s rozměry srovnatelnými s viry. Právě i díky své malé velikosti však mají řadu extrémně zajímavých vlastností, které se navíc dají různým způsobem modifikovat (polovodiče, magnety). Je to dáno tím, že dopováním různými prvky narušíte jejích krystalovou mřížku.

Fluorescenční nanodiamanty pro medicínu a biotechnologie

Nanodiamanty se totiž mohou umístit do buňky nebo navázat na nějakou buněčnou strukturu a jako určitý druh senzoru sledovat její fungování.

Nanodiamanty lze využít i pro transport léčiv do potřebného místa organismu. Mají totiž schopnost zachycovat různé látky na svém povrchu. V případě, že půjde o fluorescenční nanodiamant, je možné sledovat jeho cestu a zda se dostane do správného místa.

Velmi odolné mazadlo se získá smícháním sulfidu molybdeničitého a nanodiamantů.

Příspěvky: 1 273

Zaregistrován

29. 11. 2020

Příspěvky: 22 583

Zaregistrován

23. 10. 2006

Doplním ešte o jednu sľubne vyvíjajúcu technickú udalosť, diamant je klasická štvôr mriežka, už nejakú dobu prebiehajú technické pokusy z materiálom tvrdosti diamantu, ale osem mriežka, dokonca menšie kusy vedia vyrobiť v kvalite IF.

Múdry sa teší objaveniu pravdy, hlupák falošnosti.

Příspěvky: 22 583

Zaregistrován

23. 10. 2006

RAPAPORT

Market Comment

April 4, 2024

News: Market slow amid seasonal lull in US and India retail. Belgium quiet during Easter holiday. RAPI for 1 ct. -0.6% in Mar., reflecting weakness in VVS+ diamonds. SIs stronger. Rough prices stable at De Beers sight; buyers finding better prices at tenders and auctions. Polished buyers demanding exporters provide origin statements even for diamonds under 1 ct., beyond requirements of sanctions. Okavango becomes Natural Diamond Council’s first non-mining member. Rapaport publishes standards for source certification. Mountain Province 2023 sales -15% to $243M, average price -17% to $90/ct., loss of $32M vs. 2022 profit of $36M. Blackstone reportedly planning to list IGI on Indian stock exchange.

Fancies: High inventories of Ovals and Pears due to slow sales and imbalance between supply and demand after Indian manufacturers shifted from rounds to fancies last year. Cutters now returning to rounds. Sellers are flexible on prices. Downtrend continues. Weakest size is 0.70 ct. category. Sales of Hearts, Princesses and square Cushions low. Longer Ovals, Pears, Radiants and Cushions bringing higher prices. Goods with medium and short ratios harder to sell. Supply shortages supporting prices for Marquises. Well-cut stones hard to find and commanding premiums. Oversizes trading at higher prices than usual. Off-make, poorly cut fancies illiquid.

United States:

Retail quiet during slow season between Valentine’s Day and Mother’s Day. March was okay, but start of April has been sluggish. Dealers starting to prepare for JCK Las Vegas show (May 31 to June 3). Steady melee demand. Hard to replace inventory of 1.75 ct. and larger, G-I, SI, 3X diamonds in both round and fancy shapes.

Belgium:

Trading reduced during Easter period. Rough market steady over De Beers sight week. Delays at Antwerp Diamond Office easing.

Israel:

Market weak, with suppliers struggling to make sales. Unclear whether downturn is seasonal or due to deeper market issues. VVS and VS slowing; SI1-I1 improving. Diamonds with fluorescence and black centers selling if prices are low enough to interest buyers.

India:

Demand declining due to drop in overseas and domestic orders. Extra controls on cash movement during election season impacting transactions. Stable market for round, 1 to 1.99 ct., G-H, VS-SI, 3X diamonds with no black center. Melee demand down.

Hong Kong:

Activity seasonally slow. Solid demand for engagement rings supporting market for 1 ct., D-G, VVS-SI1, 3X, GIA-graded diamonds with no fluorescence. Dealers offering deeper discounts on VVS to attract buyers. Jewelry manufacturers in mainland China focusing on gemstones, gold and pearls in response to consumer preferences.

Múdry sa teší objaveniu pravdy, hlupák falošnosti.

Příspěvky: 22 583

Zaregistrován

23. 10. 2006

RAPAPORT

Market Comment

April 11, 2024

News: Market quiet. US and India retail seasonally slow. China slump continues. G7 sanctions causing confusion. Weak demand for round, 0.30 to 2.99, J-L, VVS-VS diamonds. Fancies slow. AGTA bans sales of synthetic stones at its shows. UK regulator censures Skydiamond for calling its synthetic diamonds “real.” Rough dealers struggling to make premiums on 3-grainer and larger De Beers goods after buying them at high prices. Stargems to acquire Petra’s Koffiefontein mine. US inflation rises to 3.5% in Mar. Oval brilliant, 55.55 ct., D-flawless diamond sells for $5.8M ($103,986/ct.) at Sotheby’s Hong Kong. Martin Rapaport and Sarine CEO David Block to host source certification webinar on Tue., April 16, at 11 a.m. EDT.

Fancies: High inventories of Ovals and Pears due to slow sales and imbalance between supply and demand after Indian manufacturers shifted from rounds to fancies last year. Cutters now returning to rounds. Sellers are flexible on prices. Downtrend continues. Sales of Hearts, Princesses and square Cushions low. Longer Ovals, Pears, Radiants and Cushions bringing higher prices. Goods with medium and short ratios harder to sell. Supply shortages supporting prices for Marquises. Well-cut stones hard to find and commanding premiums. Oversizes trading at higher prices than usual. Off-make, poorly cut fancies illiquid.

United States:

Market stable. Sales slower due to seasonal retail lull. Smaller independent jewelers taking cautious approach to inventory. Supply constraints supporting demand for round, 1.25 to 2 ct., G-I, SI, 3X diamonds with no black center. Dealers starting to prepare for JCK Las Vegas show, with hopes the market will pick up.

Belgium:

Activity slow due to religious holidays. Steady demand for 1 to 2 ct. diamonds. 0.30 and 0.50 ct. moving; 0.70 ct. weaker. Fancy shapes with good proportions selling well. G7 sanctions regime facing resistance from traders.

Israel:

Market seasonally slow ahead of Passover holiday. Ongoing war with Hamas impacting sentiment and trading. Attendance at bourse lower than before war. Few dealers traveling overseas for business. G7 sanctions adding to uncertainty. Israel 1Q polished exports down 32% year on year at $566.2 million.

India:

Overseas and domestic demand weak. Some orders of 1 to 1.99 ct., G-H, VS-SI, 3X diamonds. Stones with brown, green or milky tints (BGM) and those with black centers are hard to sell. Fancies slow; only stones with excellent proportions moving. Ongoing concerns about impact of G7 sanctions.

Hong Kong:

Trade seasonally slow. Sluggish demand from stores in mainland China. Jewelry manufacturers operating below capacity and focusing on low-cost goods. Best categories are 0.30 to 0.50 ct. and 1 to 1.50 ct., D-J, VVS-SI1, 3X diamonds, but transaction levels low.

Múdry sa teší objaveniu pravdy, hlupák falošnosti.

Příspěvky: 22 583

Zaregistrován

23. 10. 2006

May 2, 2024

News: Market shaken by reports that De Beers is up for sale. Deal could lead to restructuring of diamond trade amid ongoing pressure from synthetics, sanctions and weak Chinese demand. Anglo American rejects $39B bid from BHP. De Beers reduces 2024 production plan by about 10% to 26M-29M cts. Market slower than usual for this time of year. Slow polished sales lead to sluggish rough demand ahead of De Beers sight. Short working week due to holidays. Luk Fook FY4Q retail sales +5% YOY, but China diamond sales down more than 40%. Mountain Province 1Q sales -31% YOY to $66M, average price -29% to $70/ct.

Fancies: High inventories of Ovals and Pears due to slow sales and imbalance between supply and demand after Indian manufacturers shifted from rounds to fancies last year. Cutters now returning to rounds. Sellers are flexible on prices. Downtrend continues. Sales of Hearts, Princesses and square Cushions low. Longer Ovals, Pears, Radiants and Cushions bringing higher prices. Goods with medium and short ratios harder to sell. Supply shortages supporting prices for Marquises. Well-cut stones hard to find and commanding premiums. Oversizes trading at higher prices than usual. Off-make, poorly cut fancies illiquid.

United States:

Seasonal lull due to Passover. Trade preparing for Mother’s Day (May 12), with National Retail Federation predicting 10% year-on-year drop in jewelry sales to $7 billion. Federal Reserve holding interest rates at 5.25% to 5.5%.

Belgium:

Very short week for many traders due to Passover and Labor Day. Business expected to pick up in coming days. Overseas demand slow. Rough market uncertain ahead of next week’s De Beers sight.

Israel:

Dealers gradually returning from Passover vacation. Market sluggish due to seasonal decline in retail orders and ongoing weakness in Chinese demand.

India:

Sales slow, with little overseas demand. Some interest in round, 1 to 1.99 ct., D-I, VS-SI diamonds. Melee with SI clarity moving better.

Hong Kong:

Mainland diamond demand remains low. Muted expectations for Golden Week retail sales. Consumers showing strong appetite for gold.

Múdry sa teší objaveniu pravdy, hlupák falošnosti.

Příspěvky: 22 583

Zaregistrován

23. 10. 2006

RAPAPORT

Market Comment

May 16, 2024

News: Anglo American to sell off or IPO De Beers; BHP’s $43B second offer for Anglo rejected. Diamond market slow. India April polished exports -17% YOY to $1.2B, rough imports -19% YOY to $1.2B. Round prices falling in IF-VS1; SIs rising. GemGenève weak, with reduced sales and attendance. Focus shifts to Las Vegas. De Beers cuts Lightbox prices by up to 40%. Geneva Magnificent Jewels auctions: Christie’s raises $54M, selling pear modified brilliant, 202.18 ct., fancy-intense-yellow SI1 for $6.7M ($33K/ct.); Sotheby’s totals $34M, including round-cornered square brilliant, 37.61 ct., E, IF diamond for $4.3M ($114K/ct.). Brilliant Earth 1Q sales flat at $97M.

Fancies: High inventories of Ovals and Pears due to slow sales and imbalance between supply and demand after Indian manufacturers shifted from rounds to fancies last year. Cutters now returning to rounds. Sellers are flexible on prices. Downtrend continues. Sales of Hearts, Princesses and square Cushions low. Longer Ovals, Pears, Radiants and Cushions bringing higher prices. Goods with medium and short ratios harder to sell. Supply shortages supporting prices for Marquises. Well-cut stones hard to find and commanding premiums. Oversizes trading at higher prices than usual. Off-make, poorly cut fancies illiquid.

United States:

Stable demand for 3 ct. and larger, I-M, VS-SI2 goods in rounds and fancies. Marquises, emeralds and ovals selling. Melee improving, especially in I-J, VS-SI qualities. Synthetics prices falling. Industry focusing on JCK Las Vegas.

Belgium:

Trading quiet. Demand and supply both limited. Buyers highly selective. Bread-and-butter items hard to sell. Exceptional fancy-color stones moving well. Many dealers not attending Las Vegas shows.

Israel:

Short week due to Independence Day. Muted sentiment amid slow overseas orders. April polished exports down 1% year on year at $140M.

India:

Domestic demand supporting market; overseas orders sluggish. Low expectations for upcoming JCK Las Vegas show. Steady interest in round, 1 ct., D-J, VS-I1, 3X diamonds with no brown, green or milky (BGM) or fluorescence. VVS slow. Fancies weak. Melee moving in SI-I1 clarities.

Hong Kong:

Weak mainland demand negatively impacting wholesale trade. Chinese consumers choosing gold rather than diamonds. Low-budget jewelry selling during Mother’s Day season.

Múdry sa teší objaveniu pravdy, hlupák falošnosti.

Příspěvky: 22 583

Zaregistrován

23. 10. 2006

RAPAPORT

Market Comment

May 23, 2024

News: US suppliers cautiously optimistic for Las Vegas shows, as jewelers have reduced inventories. Indian market slow as dealers reduce buying. Prices of round, 1 ct., D-J, IF-VS1 diamonds continue to drop. SI2 improving. Fancy shapes weak. Reuters reports US govt. “has cooled on enforcing traceability” regarding Russian sanctions, with Signet lobbying against G7 Belgium solution. Plans for sale of De Beers creating uncertainty. Okavango May rough sales +84% YOY to $104M amid price drop in 3 gr. and larger sizes. FY 2024 sales at Richemont jewelry maisons +6% to $15.5B. De Beers and Signet to collaborate on natural-diamond marketing. Israel bourse elects Nissim Zuaretz as president.

Fancies: Fancy-shape prices weaker following strong demand last year and overproduction by manufacturers. Pears slower than other shapes. Market for Ovals not as hot as it was. Elongated shapes still preferred. Goods with medium and short ratios harder to sell. Supply shortages supporting prices for Marquises. Well-cut fancy-shape diamonds hard to find and commanding premiums. Oversizes trading at higher prices than usual. Off-make, poorly cut fancies illiquid.

United States:

Exhibitors shipping goods ahead of JCK Las Vegas and Luxury shows. Expectations mixed, but outlook favorable for suppliers that have made client appointments. Hard to rely on walk-in traffic. New York market stable. Retailers buying well-cut ovals, emeralds and elongated cushions in 3 ct. and larger sizes. Some interest in 3 to 5 ct. diamonds. Large companies that sell straight to retailers doing okay; trading between small dealers slow.

Belgium:

Business seasonally slow. Chinese demand weak. Diamonds in short supply following drop in manufacturing levels. Many dealers not attending Las Vegas shows. Some orders for melee, 0.50 ct. and 1 ct. rounds in D-I, VS1-SI2 categories. Fancy-color diamonds difficult to replace. Traders concerned about future of De Beers.

Israel:

Preparations for JCK Las Vegas have boosted bourse activity as exhibitors prepare inventories. Fewer companies attending than in previous years, and costs have risen. Dealers remain nervous amid sluggish US and Chinese demand.

India:

Market quiet. Manufacturers cautious about JCK Las Vegas amid slow orders from dealers. Suppliers focusing on show rather than local sales. National election negatively impacting domestic demand. Slowdown in round, 1 ct., D-J, VVS-SI, 3X diamonds with no brown, green or milky (BGM) or fluorescence. Melee moving in VS2 to SI2, with supply shortages.

Hong Kong:

Market improving. Retailers buying round, 0.30 to 0.80 ct., D-H, VVS-VS, 3X diamonds. Fancy shapes moving well in 1 to 2 ct., D-J, VVS-VS ranges, with jewelers offering deep discounts to attract consumers. Steady Mother’s Day sales. Rallying stock market is lifting consumer sentiment. China jewelry manufacturers focusing on gold products.

Múdry sa teší objaveniu pravdy, hlupák falošnosti.

Pro vkládání příspěvků se musíte přihlásit.